All the information you could ever need on home contents insurance – explained in plain English.

If you’ve ever had a phone stolen or had your geyser burst, you’ll know that replacing items and repairing damage is never a cheap exercise! Unless you’re lucky and loaded with lots of money in the bank. And if not, home contents insurance can protect you when bad things do happen.

Here's everything you need to know

Why do I need home contents insurance?

Life happens and there’s no way of predicting how or when bad things will happen. If you aren’t flush with cash to handle those setbacks, you could end up financially strapped. Home contents insurance is designed to cover the cost if any of your stuff is damaged, stolen or lost. It’s a popular type of insurance if you want to protect your stuff, whether you own or rent your home.

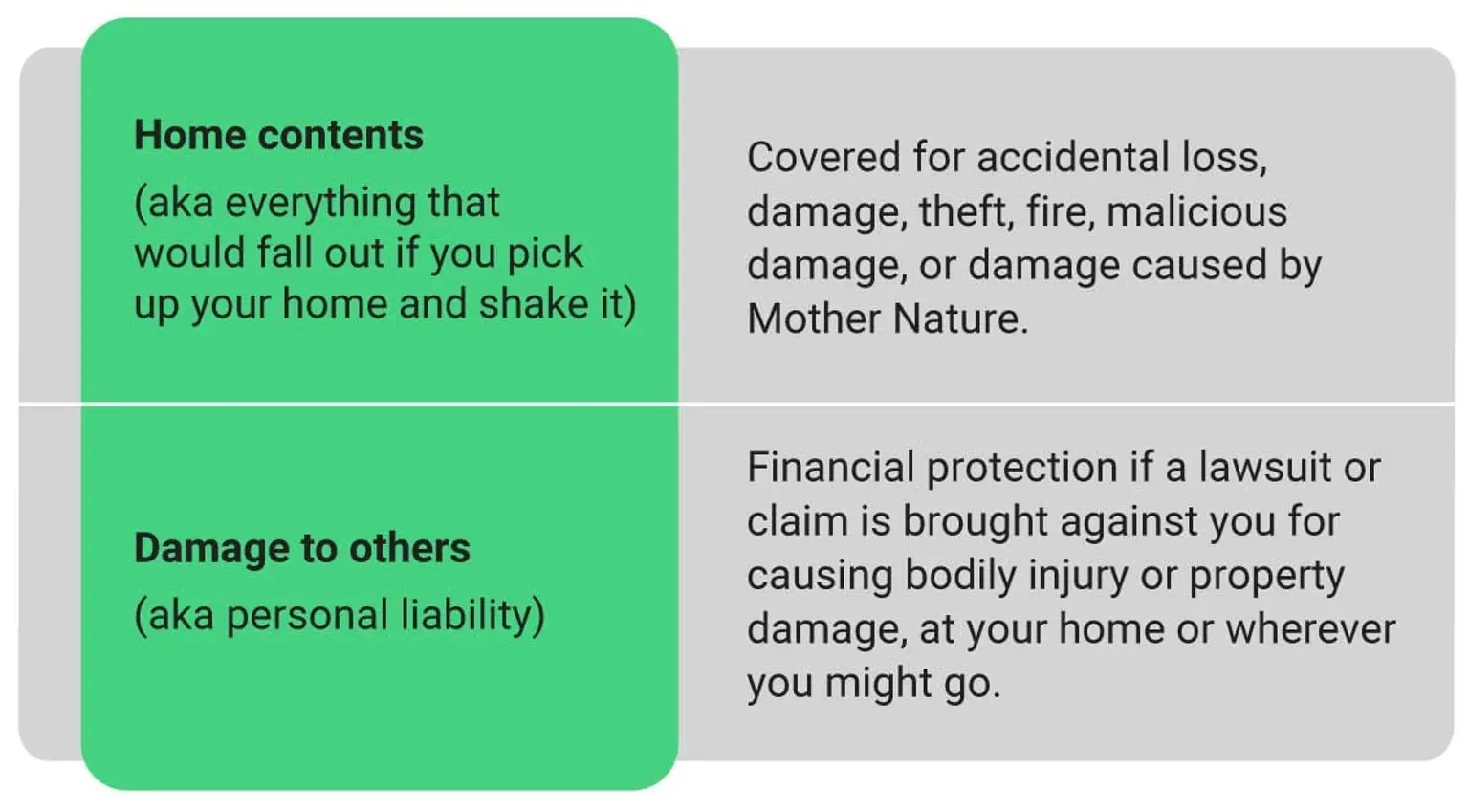

What is home contents insurance?

Home contents insurance will pay for the accidental damage, loss or theft of your things while they are at home. Some contents policies will also cover your things when taken out of your home. Lastly, your contents insurance gives you financial protection if you are held legally responsible for causing either bodily injury to someone or damage to their property.

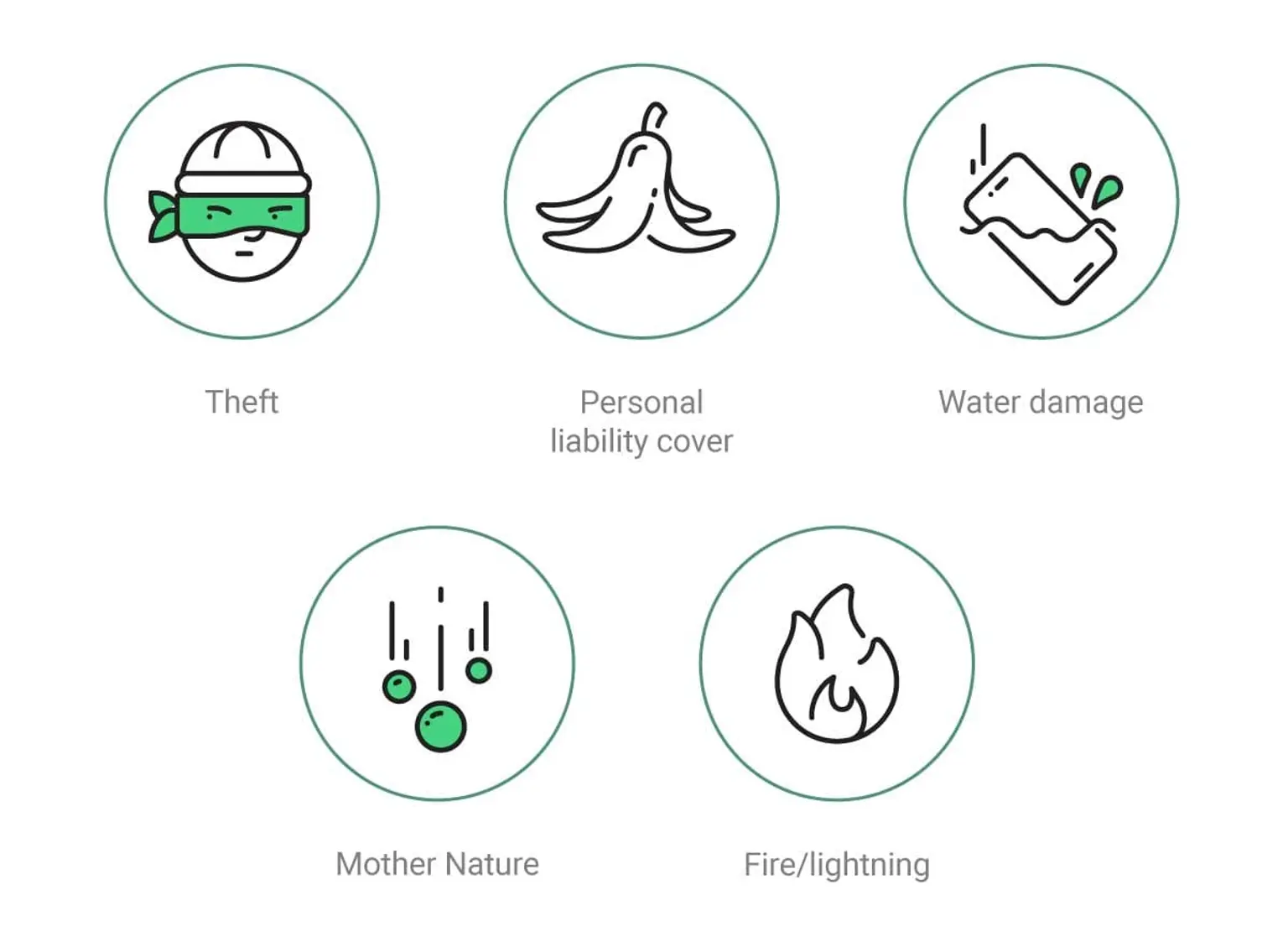

What is covered?

Home contents insurance will cover all of your stuff, while it is in your home, from bad things like:

- Theft;

- Fire, lightening, explosion;

- Malicious damage;

- Damage caused by Mother Nature (like earthquakes, storms, floods, hail etc.);

- Damage caused by leaking or overflowing of water from geysers, tanks, pipes or gutters.

A limited amount of accidental damage might be included in your standard policy but more coverage for accidental damage or loss is usually an optional extra that you can buy (things like accidentally bumping your TV to the floor).

Many policies automatically add additional limited/capped benefits like:

- 24/7 Home emergency assistance;

- Loss of keys and remote control units, or damage to locks of the home;

- Cover for washing on the line;

- Damage to electrical appliances due to power surge;

- Coverage for some items kept outdoors like patio furniture and the like; and

- The cost of replacing important documents like marriage certificates, etc. after an insured event.

Whose stuff is covered under my contents policy?

Your children’s and your partner’s things are considered “yours” by most insurers. So as long as their values are included in the overall sum insured amount, they will be covered. A sum insured is the maximum amount that your insurer will pay if you make a claim for a covered event.

If you live in a commune, the stuff owned by the other people you live with is not covered. Your domestic workers’ items also won’t be covered under your contents policy.

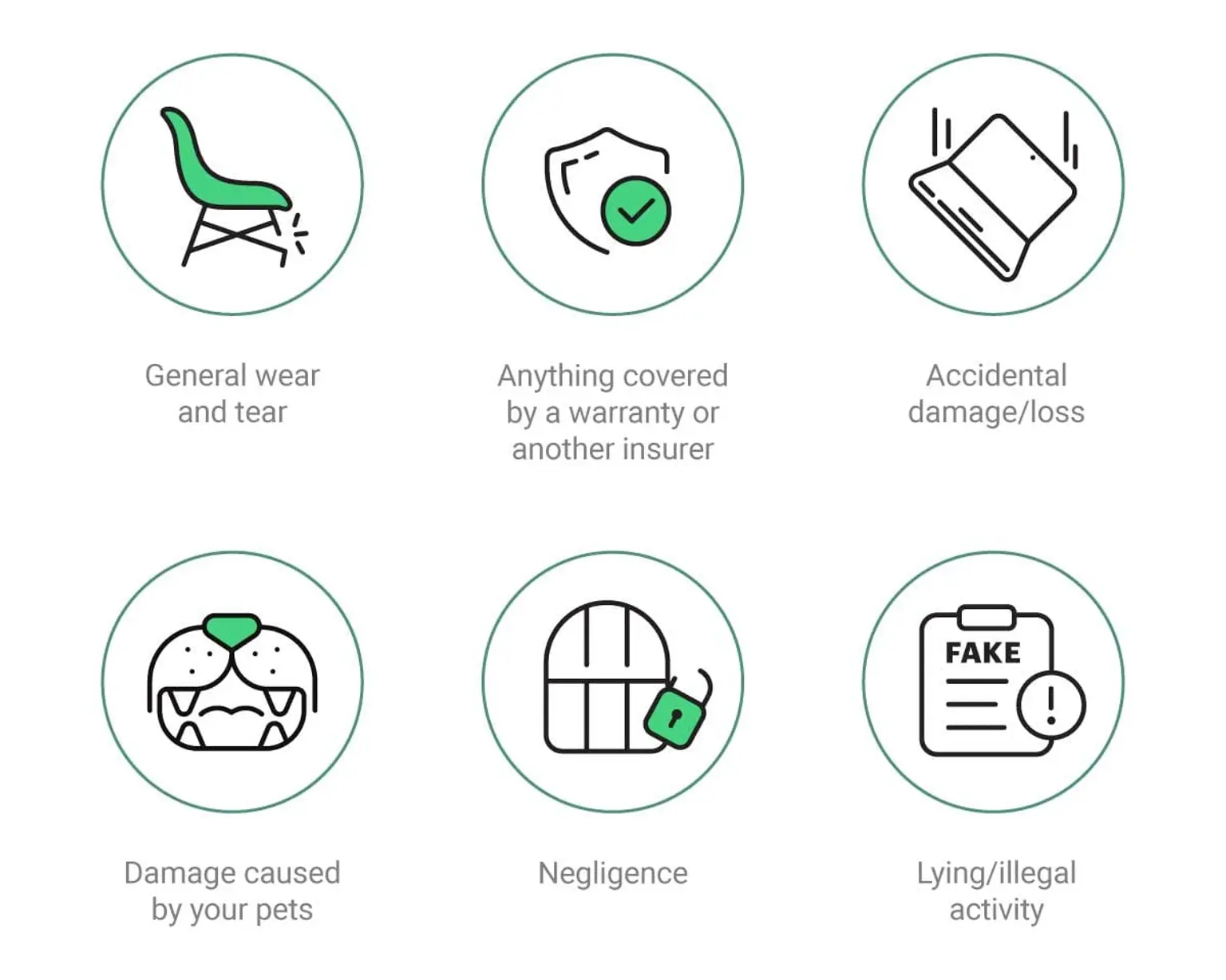

What am I not covered for?

Think of home contents insurance as a buffer for the unforeseen and unexpected. It doesn’t cover everything and anything that can go wrong. To know what your specific insurance covers, it’s best to read your policy wording – specifically the exclusions section.

Here are the most general things insurers do not cover:

General wear and tear

Any loss or damage to your stuff as a result of day-to-day use is not covered. For example, you will not be covered if the material on your couch is worn through from old age or your refrigerator stops working because it's just old and needs to be replaced.

If your dog chews the couch

Most insurers will not cover any losses or damage caused by pets, rodents or insects. So if your new puppy has itchy teeth and attacks your couch there will be no cover for that.

Anything covered by a manufacturer’s warranty

Anything that would, as a rule, be covered under the manufacturer’s warranty won’t be covered by your insurance company. This will still apply even if your warranty or service plan has expired.

If you have already insured any of your items somewhere else

Any item can only be insured once and you will never be able to claim on the same item from two different insurers. For example, if you insured your couch as part of your credit purchase agreement it will not be covered by your contents cover as well.

Accidental damage or loss

Many contents policies will exclude coverage for accidental damage or will limit the cover very explicitly to a certain amount or specific items. It’s best to check your policy wording for anything referencing accidental damage.

Any loss or damage to the building you live in

If the building in which your contents are kept is damaged there is no coverage for that, you need to buy building insurance to cover the building itself and its fixtures.

Losses as a result of you not taking reasonable care of your stuff

If you leave your items out in the open on your property or in an unattended car and they get lost or damaged they will not be covered.

No proof of ownership

Your insurer will usually require you to produce proof of ownership, especially when valuable items like a TV or jewellery is stolen. If you cannot provide them with proof of ownership the claim might not be paid.

Any damage caused by alteration or renovations

If while building your new kitchen the contractors damage something in your home or steal any of your stuff, you will not be covered. It’s a good idea to check that the contractor coming to work in your home has insurance themselves before they start working on your home.

Any losses due to you conducting business from home

It’s best to check your policy wording when it comes to what your insurer will cover if you’re conducting business from your home. Generally, you don’t have any cover for items that are used for business. This includes electronics, professional equipment, stock, inventory or raw materials. You also won’t be covered for any events that are directly related to the property or any items being used for business. For example, if you have a photography studio on your property and your model slips and breaks her arm while on the job, there will be no cover under your contents insurance. There are specific business insurance policies that are designed to cover you for that.

If you lie

Before you buy contents insurance, the insurer asks you a couple questions to try to understand your risk. If it’s found out that you weren’t honest when answering these questions, and you file a claim, you will not be covered. You will also not be covered if it is found that you were dishonest when making a claim (like pretending you had a TV that was more expensive than the one that was stolen).

If you suffer a loss while involved in some illegal activity

If any of your stuff is damaged because you were involved in an illegal activity your insurer will not cover any of the losses.

Certain items might be explicitly excluded from cover

Best to check your policy wording but many insurers exclude coverage for items like money, cheques, gift vouchers, stamp collections, or motorised equipment like golf carts and drones.

What if I take my stuff out of the house, is it still covered?

Some home contents’ policies give you the option to cover the things that you take out of your home, such as sports equipment, laptops, phones, jewellery and other portable possessions.

These items will usually need to be specified on your policy and will then be separately listed under an “all-risk” or “portable possessions” section in your policy. If you decide not to explicitly specify your portable possessions for cover away from your home, they won’t be covered or at best will have limited cover. Limited cover would, in most cases, be insufficient to replace the item if something bad happened to it away from home.

At Naked, we require you to specify all easily portable items worth more than R5,000 for them to be covered for accidental loss, damage or theft, at and away from your home.

Am I automatically covered for accidental damage?

If you try to mount your flatscreen TV on the wall and drop it in the process you will not necessarily be covered. Some insurers will require you to explicitly add additional cover for accidental loss or damage. Alternatively, your insurer might limit the coverage to certain items or a specified amount. Best check your policy wording for that. At Naked, you must specify all items that you want to be covered for accidental damage or loss.

Is my pet covered as part of my contents?

Your pet isn’t considered “contents” so they are not covered if they are stolen, pass away or are injured. If you want to cover your pet for these things you will need to take out pet insurance.

However, you do have cover if your pet injures someone else and you are held legally responsible for the resulting costs.

How much home contents cover should I buy?

The amount of home contents insurance you buy purely depends on how much stuff you have. The more you have to lose, the more insurance you will need. Before you buy insurance, it is important to take stock of everything you have and how much it will cost to replace each item as new today.

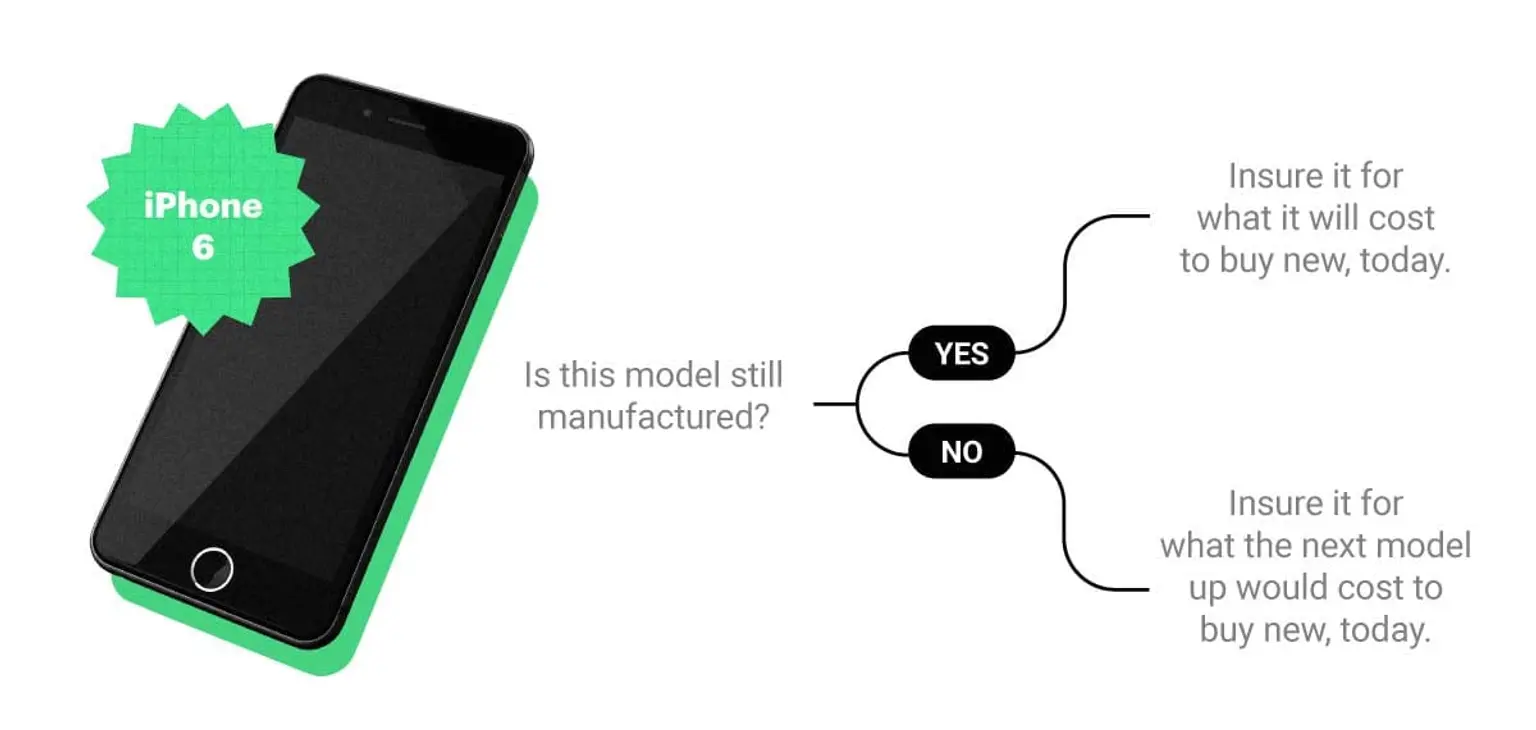

Most insurers insure your items as “new for old”. For example, if you want to insure your iPhone 8, you will need to insure it for the price that it costs to buy new today – not what it would’ve cost you three years ago and not what a three-year-old iPhone 8 would cost you today. This is known as replacement value.

Once you have taken stock of everything you own and how much it will cost to replace it all, this is the amount you give your insurer. It’s known as your sum insured and it will be the maximum amount that your insurer will pay out in the event of a claim.

For more information on how to accurately calculate the amount your things cost, check out this.

What happens if I insure my stuff for less than it’s worth?

When insuring the contents of your home, you might unintentionally insure your things for less than they’re worth. This is known as underinsurance.

It may sound harmless, but when it comes to claiming you won’t receive the insurance payout you were expecting and will have to cover the balance yourself.

What is underinsurance?

Underinsurance is when the amount you’ve chosen to insure all your belongings for is less than their actual replacement value, i.e. what everything will cost to be replaced as new.

The bad news is that you will usually only find out if you’re underinsured when you make a claim, and your insurer sends an assessor to determine the value of your loss or damage.

Insuring your stuff for its replacement value is important to ensure you are not out of pocket after a claim. For example, if you insured your contents for R200,000 but they are worth R400,000, you have effectively only insured half of your contents. So your insurer will only pay out half of any claim you make, whether you’ve lost all your stuff in a fire or if you had a break-in where only a couple of things were stolen. This practice is referred to as applying the principle of ‘average’.

For more information on underinsurance and how to avoid it, take a look at our blog.

How often should I update my sum insured?

The value that you give your insurer should be reviewed at least once a year. You may find that you have bought a few valuable items that need cover. But if this isn’t the case, then you should at least consider upping the value with inflation each year — the price of replacing your things will go up as inflation does.

What is personal liability cover and why do I need it?

Most contents policies will include personal liability (damage to others) cover. This covers you from being held liable to pay someone compensation following:

- Them being injured on your property; or

- You accidentally damage their property, apartment or belongings; or

- You accidentally damage your rented property; or

- A person (including housekeepers, au pairs and gardeners) or pet that’s a part of your household accidentally injuring another person or pet. Like your dog biting someone and them holding you responsible for the doctor’s bills or your gardener using the weed eater and a stone flicking up and cracking a passer-by's windscreen.

Personal liability cover will also cover the cost of your legal fees if you feel you are not responsible for what happened.

Who is covered by my personal liability cover?

Generally, you, your partner, your children, your pets and domestic workers are covered for personal liability (damage to others) under your home contents policy.

What isn’t covered by personal liability?

This depends on the specific circumstances of your claim and your insurer. But here are a few common examples of where personal liability won’t cover you:

- Injury caused by someone who isn’t a part of your household

- Injury or property damage caused by business activities

- Personal injury to yourself or a member of your household

- Damage caused by your car (this is covered by third-party liability on your car insurance)

- Anything as a result of illegal activities

- Injury or property damage done on purpose

How much personal liability cover should I buy?

When first insuring your stuff your insurer should ask you how much personal liability cover you want. It’s quite a hard question to answer as you have to picture yourself in the worst-case scenario – a scenario that is also very rare. But crazy things happen. Something like a tree in your property falling on a R5-million BMW X6 – this might not be something you can afford to pay off yourself for the rest of your life.

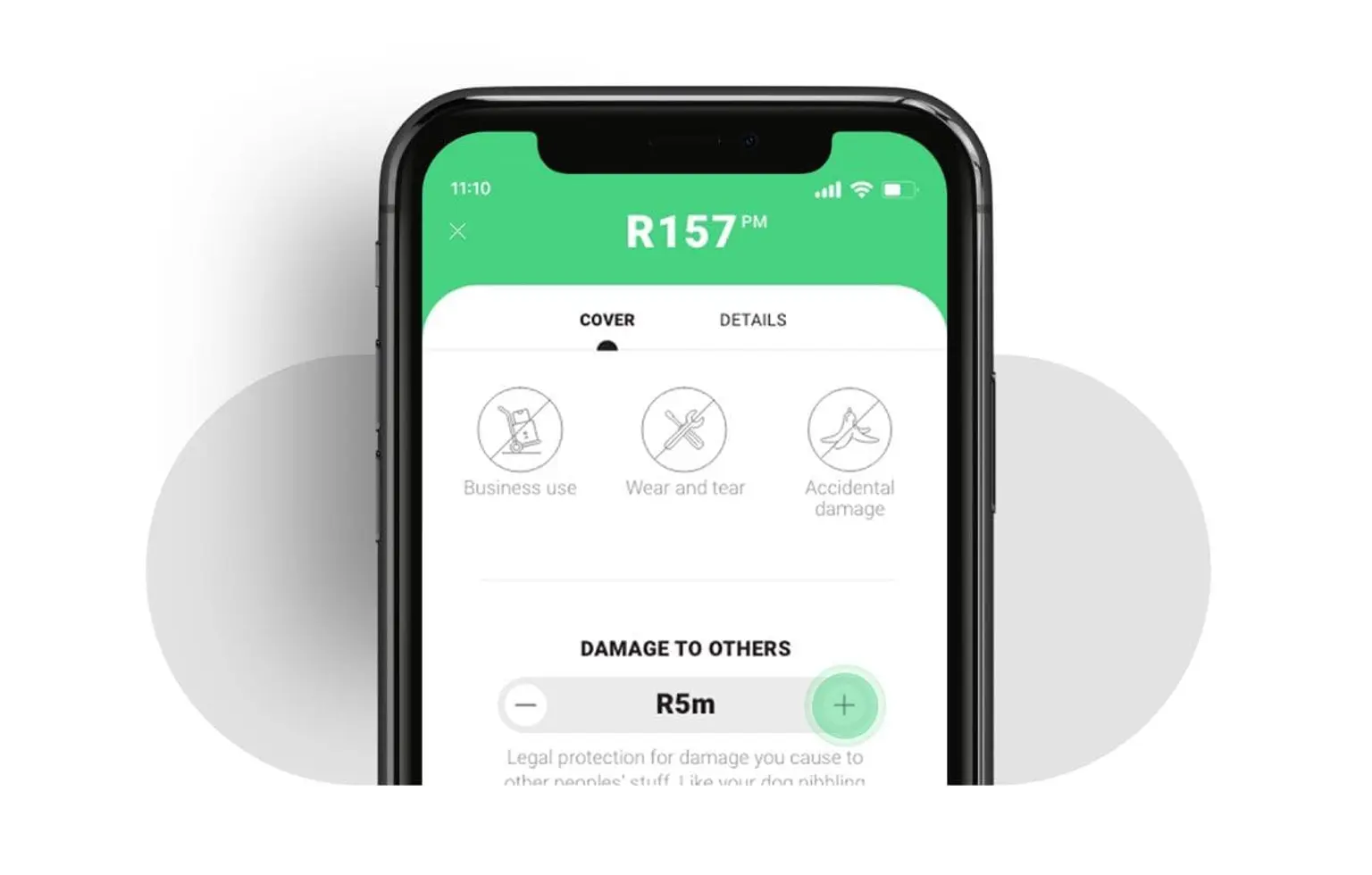

Instinct would tell you to go for the highest amount of coverage that your insurer offers. But this might not always be affordable. The more cover you buy, the higher your premium will get. So you might want to think about the highest amount of premium you can comfortably afford to pay each month.

At Naked our average policyholder goes for R5-million in personal liability cover – the minimum is R2-million and the max is R10-million. It sounds like a lot of money until something does go wrong and you are held liable. You can easily see how much your premium changes depending on what liability cover you want on our app.

Everything you need to know about your home contents insurance premium

Premium refers to the amount you pay to your insurer to take on the risk to cover your stuff against a set of specified events listed in your policy wording.

What makes up my insurance premium?

- Your contents insurance premium will be based on factors specific to you, as well as factors specific to your insurer. Here’s what determines your home contents insurance premium:

- Factors specific to you, like where you live, your security, your claim record, etc. Your insurer uses these factors to estimate how likely you are to make a claim and its likely size if you do. All else equal, someone without any security will pay more than someone living in a fortress.

- How your insurer sells policies. For example, call centres and brokers are generally more expensive than selling online.

- The use of technology to service policies and claims. For example, with some insurers, you have to phone in to make a claim, while with others you can claim through an app, which is cheaper.

- Cash-back benefits. If you are promised cash back for not claiming, the insurer usually loads your premium to fund this benefit.

- Profit. Some insurers load for more profit than others.

What things affect my insurance premium?

Where you live

Your premium will change depending on where you live. There are several reasons for this. The main ones are exposure to crime and exposure to natural disasters. Living in an area with a high crime rate means there is a higher chance of burglary. Living in a house built on a floodplain is of course more exposed to flooding than a house built on a hill.

When shopping for a new home, it’s a good idea to get an insurance quote on the address before making the purchase – you could avoid a high insurance premium as well as get a feel for the riskiness of the area you’re considering.

How well your property is protected against bad guys

Security systems work. If you have an electric fence, alarm system, or burglar bars on all your windows, it’s less likely that you will be burgled. Most insurers will use your level of security when determining your premium – the better it is, the lower your premium will be.

If you’re procrastinating upgrading to that new security system, it might help if you got a quote from your insurer on how it would affect your premium. The monthly savings might be enough of a push for you to pull the trigger on the purchase.

The value of your stuff

All else being equal, the more things you own, the higher your insured value needs to be and this will directly mean a higher insurance premium.

This is definitely a strong motivating factor to get rid of the stuff that you don’t need anymore. We all have unwanted things clogging up our cupboards – besides the waste of cupboard space, all this stuff inflates our premiums.

What your home and roof is made of

There are several things that an insurer might ask you here. A common one is whether you have a thatch roof. Another is whether your home is built with wood. Both of these are fire hazards – if a fire breaks out, it’s that much more likely to result in spreading across your whole home.

If you are considering moving to a new place with a thatch roof, you might want to stick the fact that you’ll be charged a higher insurance premium (and have a higher chance of a fire!) into the con column.

What you use your home for

The main thing to consider here is whether you use your home for your job or not. If your home office is little more than a desk and a laptop, then your insurer is unlikely to increase your premiums. But if you, say, are a professional photographer with a photography studio in your garage, or if you rent your home out for money, then the risks that your home is exposed to are very different to those resulting from normal use. Your insurer is likely to charge you a higher premium.

When thinking of setting up a home studio, take the increase in premium into account – it might be more worthwhile to rent space at an existing studio.

How many people are living with you

Usually the more people you live with, especially if they are not related to you, the more expensive your premium will be.

It’s hard to make changes here to influence your premium – your insurance premium is unlikely to influence your decision about who to live with! But you can at least make sure that your insurer understands the nature of your relationship with whoever you’re living with. Living with a roommate is likely to be more risky than a spouse – so if you didn’t tell your insurer that you’re living with a spouse when you signed up, give them a call now. And if you marry your roommate, remember to update your policy!

How often you have claimed in the past

Insurers often take your past claims experience as a guide to your likely future claims experience. If you’ve had 3 claims in the past year, you’re statistically more likely than someone who has been claims-free over the last 12 months to have a claim next year.

Thankfully, your claim record doesn’t stay with you forever – most insurers only look at the past 2-3 years. So if you’ve been unlucky in the past, being extra careful in the future (putting up an electric fence, being disciplined about activating your alarm when away, etc.) should pay off through your premiums increasing by less than others’ each year when your policy is renewed.

How many years you’ve been insured without a break

The longer you’ve had insurance for, the lower your premium should be. This is because your insurer will know that you do not only buy insurance when things are extra risky (like going away on holiday and leaving your home empty) and they’ll know that they can trust your claim record.

This is one of the easier dials to turn – keeping yourself insured should mean lower premiums in the long run.

The insurer you choose

The premium that the insurer sets takes all of the above factors into consideration when assessing your risk (the expected value of your future claims).

But simply charging the correct amount to cover the expected costs of your claims in any one month won't be sufficient to enable the insurer to pay their staff and run their business. Insurers include an additional amount to ensure they can cover their running costs and some profit for shareholders.

Here’s a breakdown of possible running costs. Keep in mind that it varies from insurer to insurer, but these are generally the main factors that influence running costs:

How policies are sold: If you need to go through a broker or a call centre the cost will be considerably higher than if you can only buy your policy directly online like with Naked.

The use of technology to service policies and claims: For example if you need to call in to make any changes to your policy or to submit a claim rather than making the changes yourself on an app, the cost of servicing your policy will be much more.

Cash back benefits: If you are said to receive any rewards for not claiming there will be a loading added to your premium for the expected cost of any such payout.

Tax: A loading for value added tax.

Profit: To make sure that insurers can pay your claims if something bad happens, they need to hold a certain amount of capital on their balance sheet by law. Just like with any investment, the providers of this capital need a return. So your premium will be increased with an amount to allow for this required level of return. In essence, their return = premium - claims - expenses.

If I do not pay my premium do I still have cover?

If it is your first premium payment, you have to pay it in full before you will have any cover. From your second premium, you will have at least 15 days' grace to pay for your insurance from the date that your premium is normally due. During this period you still have cover if something were to happen to your stuff. However, your insurer will require you to settle your outstanding balance before they consider any claims. Check your specific wording, as some insurers will give you a slightly longer grace period.

Why do my premiums change every year?

Insurers generally review your premium once a year on the anniversary of your policy. At that time your premium will usually increase or decrease depending on a few factors:

- Inflation – Each year as inflation goes up, so does the cost of replacing and repairing damage to your stuff.

- An increase in the value of your stuff – Many insurers will automatically increase your sum insured by inflation every year. However, if they don’t it is recommended that you review your sum insured at least annually.

- The number of claims you've had in the past year – If you signed up with zero previous claims, and then made a claim, your premium is likely to increase when it is renewed. If you instead signed up with one claim from the previous year and then made no claims, your premium is likely to decrease slightly or stay at a similar level at review.

- Factors that aren’t always specific to you – There are several factors that you might have no control over. For example, you may live in an area where a lot of break-ins happened in the past year, this could affect your premium even though you didn’t claim.

What is Sasria?

Insurance companies in South Africa don’t provide cover against loss or damage caused by war, terrorism, riots, strikes and other protest actions. Instead, there is a “special risk insurer” that provides cover for these kinds of events called the South African Special Risks Insurance Association (Sasria). When you look at the breakdown of your contents insurance premium you will usually see an amount being added specifically for Sasria cover. This small amount is paid to Sasria on your behalf by your insurer. You do, however, have the right to opt out of this cover, you just need to let your insurer know that you do not need it.

How to buy home contents insurance

If you’re looking to buy home contents insurance or are buying it for the first time, it’s best to do some research before you take the plunge! Here are a couple of steps to help you cover your belongings!

First, get a couple of quotes and read some reviews

To help you find the best cover to suit your needs and budget, do a bit of research on who the various insurers are and what their track records look like. Google, Hellopeter and even Facebook offer reviews which can help you form an opinion on each company. This will give you a good idea of what to expect if you ever have to claim.

If you already have car insurance, it might make sense to get a home contents insurance quote from the same company. Otherwise, a good place to start is to gather as many quotes as you can to compare costs and coverage.

Getting quotes can be quite time-consuming. If you are dealing with a call centre it can involve talking to a few call centre agents and a bit of back and forth on emails before getting the physical quote.

If you are strapped for time and don’t like the idea of long conversations with call centre agents, getting a quote online or on an app might be preferable.

There is also the option to use online aggregators who get you various quotes from different insurers at once. However, going this route might mean you end up with call centre agents phoning you to try and close the deal. Plus there’s the chance that you aren’t comparing apples with apples as the exact level of coverage offered by the different providers might vary.

At Naked, we give a binding quote either through the app or website which allows you to buy cover there and then – no calls required.

Compare your quotes

Once you’ve gathered quotes you’re happy with, make sure that the coverage is right for you and your needs. You want to make sure that you’re comparing apples with apples and not apples with oranges – the policy wording is a good place to start.

Consider the excess carefully. The most important thing to check when comparing quotes is to compare oranges with oranges; make sure the excess is the same on all your quotes. Also, be aware of any additional excesses that might catch you off guard.

Switching insurers

If you are switching insurers you will need to cancel your policy with your current insurer. Chat with your current insurer so that you cancel just before your new coverage starts. You don’t want to be driving without any cover in place, but you also don’t want to pay double for your insurance.

All there is to know about home contents insurance excesses

An insurance excess is the amount of money you contribute toward a claim. Your excess is selected when you buy the insurance.

What is an excess?

An insurance excess is the amount of money you contribute toward a claim. Your excess is selected when you buy your insurance.

So if you have a R3,000 excess and your laptop is stolen, costing R20,000 to replace, your insurer will contribute R17,000 and you will contribute R3,000. Think of it as, “If I claim for something covered under my home contents policy, I will contribute my excess and my insurance company will pay for the rest.”

Different insurers offer different types of excesses:

Flat excesses – Flat excesses are fixed amounts you agree to when you buy insurance. This amount is always the same; it does not change whether you have a big or a small claim.

Percentage excesses – Percentage excesses are where a certain percentage of your claim is paid by you. This means the amount you will have to contribute will vary by the size of your claim. For example, if your excess is 10% of your claim, you will contribute R10,000 if you have a claim of R100,000 and R1,000 if your claim is R10,000.

Additional excesses – Additional excesses are amounts that you are required to pay on top of your basic excess when you claim. For contents insurance this might happen if you have had multiple claims of the same type, for example, if you have had multiple claims on your cell phone.

Not all insurers have additional excesses so best to check your policy wording for that. With Naked we only have one flat excess you choose.

Imposed excesses - Your insurer might add a non-standard excess if you have had many claims from the same cause. This is usually done to allow them to continue to insure your risk. For example, if you have had multiple water damage claims to your contents due to leaking pipes, they might impose an additional excess on claims of that specific type.

How to choose an excess?

When you buy contents insurance, you choose an excess. The higher the excess you choose, the lower your premium will be and vice versa. So, choosing an excess is about finding a sweet spot between what you pay on a claim and what you can pay each month for your insurance.

One way to calculate an appropriate excess is to determine the maximum amount you can comfortably afford to pay out of your pocket if you had to make a claim tomorrow. Picking this level means you’ll avoid getting into trouble when it comes to claiming while minimising the amount you have to pay for insurance each month.

There is usually a range of excesses you can choose from, usually between R500 and R20,000. Some insurers offer the option of having a zero-excess policy where if you do claim, you won’t need to pay an excess.

How often do I need to pay an excess?

Excesses are normally required to be paid every time you make a claim.

In some cases, you might find that the damages you are claiming for cost around the same as your excess – it might make more sense to have the damage repaired yourself instead of letting the claim affect your claims history and possibly your premium.

Everything there is to know about claiming on your home contents policy

What is an insurance claim?

An insurance claim is when you make a formal request to your insurer for them to pay for the damage, loss, or theft of your property. Your insurer will need proof of the damage or incident that caused the loss or theft to pay out the claim that you are making, plus your premiums will need to be paid up before the claims process can begin.

How much time do I have to make a claim?

You generally have 31 days to let your insurer know about an event that resulted in a claim. This may differ from insurer to insurer, so just double-check the policy wording or ask your insurer directly.

As for personal liability claims, things work a bit differently. By law, third parties have the right to take you on for damages for up to three years after the accident happened. On these claims, your 31-day counter will only start once you have been approached by the third party, within that three-year window.

What if I am not sure if my claim is valid?

There is always the worry that your specific claim is not covered by your policy and that it will count against your insurance record if you do try to claim. If you are unsure about whether your insurer will cover a claim or not, do some research beforehand to see what they cover and what they don’t. The policy wording is a good first place to look. You can also always contact your insurer directly and ask, they will be able to clear up any confusion.

As for whether the invalid claim will count against you – this is only true if your insurer has already spent money on the process. For example, if they’ve sent out an assessor to assess your claim and the damage is found to be below your excess – the claim will go onto your record even though you won’t receive any compensation from your insurer.

How to claim

In the case of theft or attempted theft, you will usually need a police case number to claim. You should try to get this within 24 hours of the incident.

Then you would contact your insurer about the incident, whether it be through email, an app, an online portal or a phone call. From there your insurer will guide you in terms of what to do next – generally, they will ask you to tell them the exact details of what has happened, where it happened, when it happened and who else was involved. They might also ask for photos of the accident and contact details of witnesses, so be sure to have this information ready.

From there, your insurer should keep you up to date on the progress of your claim and what happens next. For the full lowdown check this out.

What you need to pay

When you buy insurance, you agree to an excess amount that you will be responsible for if you ever need to claim. If your item is being repaired, this amount is usually paid to the service provider who is doing the repair. If your item is irreparable, and you are going to be paid cash for the loss, your excess will be deducted from the payout.

Under what circumstances might my insurer not pay my claim?

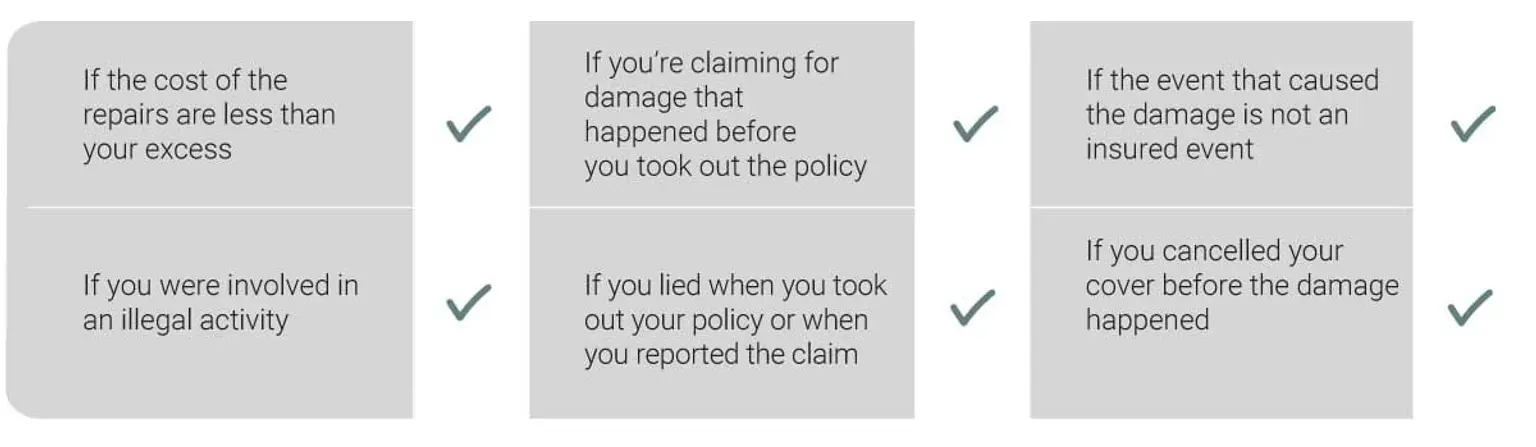

If your premiums are not up to date for the month, your insurer will insist that the outstanding balance is settled before they will consider any claim. Other possible reasons your claim will not be considered are:

- If the cost of the repairs is less than your excess;

- If you’re claiming for damage that happened before you took out the policy;

- If the event that caused the damage is not an insured event. For example, if the damage is a result of wear and tear;

- If you were involved in an illegal activity;

- If you lied when you took out your policy or when you reported the claim; or

- If you cancelled your cover before the damage happened, even if the cancellation was done a couple of days before.

Things to look out for in your home contents policy

When you buy a home contents insurance policy, you are entering into a legal agreement with your insurer. You both accept the terms of the agreement and agree not to take advantage of one another. Here is a list of things that insurers will expect of you to make sure your policy works as you expect it to:

Take good care of your things

You should protect your things from damage or theft to the best of your ability. Don’t leave items in a place where they are clearly at greater risk of being damaged or stolen. If it is found out that you were negligent, the claim might be denied. Make sure you do things like switch your alarm on and lock the doors when you leave your home and don’t leave valuable items lying around in clear sight.

Security requirements at your home

Make sure you check whether you are required to install a linked alarm or need burglar bars on all opening doors and windows or some other security requirement. If you are required to have certain security at your home and you don't, your insurer may not pay your claim if your stuff is stolen.

Administration fees

Your insurer might charge a once-off administration fee when you start your policy that will be in addition to your normal premium and is usually between R500 and R800. There is also sometimes an ongoing admin charge that insurers load onto your monthly premium – it’s usually between R15 and R100.

Activating your cover with a pre-inspection

In order to be covered, your new insurer might require an inspection of your home contents (called a pre-inspection/selfie) to prove that the contents exist and to determine whether there is any pre-existing damage. There is usually a grace period to get this done but you should try to get it done as soon as you can.

Let your insurer know if any details on your policy have changed

If the details under your insurance policy have changed, you should let your insurer know. The most common changes they would need to know about are:

- Your address – You moved to a different part of town or to another city.

- Your sum insured – You got more items/contents.

- Your security – You’ve upgraded your security with a fancy new linked alarm.

Report any damage, accidents or theft to the police and your insurer as soon as you can

If there has been an incident where your house has been broken into or a theft has occurred, it’s important to call the police as soon as you can.

Pay your premium on time

By law, from your second premium onwards, you have a grace period of at least 15 days to pay your premium but it is always best to pay your premium when it is due to ensure there are no complications when making a claim.

Update your sum insured regularly

The value that you give your insurer should be reviewed each year to avoid under-insurance.

Your insurer’s responsibility

Apart from meeting their obligations in terms of the cover you bought (i.e. what they said they would cover in the policy wording) and settling your valid claims there are several other things that you can expect of your insurer:

- Your insurer needs to give you 31 days' notice of any changes to your policy wording or premium rates.

- Your insurer needs to give you access to the details of your cover, including your full policy wording.

- Your insurer needs to provide you with a detailed breakdown of the different elements of your premium, i.e. commission, admin fees, Sasria, VAT, etc.

- Your insurer must have a complaints escalation and review process that is easy to understand, with simple requirements. They also need to make it clear where and how complaints can be submitted and what the steps are that you can expect from there.

- If your claim is rejected, your insurer needs to tell you the reason why it was rejected.

- From your second premium payment onwards, your insurer needs to give you at least 15 days’ grace to make your premium payment from the date that it was due. During this time they will keep your cover in place (you will need to settle up to have your claim paid though).

- If you are held legally liable by a third party for bodily injury, death or damage to their property, your insurer will take on the responsibility of providing representation for you if your case goes to court, provided that the event is covered by your policy. They will represent you even if the incident was your fault.

- Your insurer needs to respect your data and privacy. There is a legal requirement to keep your data for five years from any interaction – beyond this they should only keep data directly relevant to the service they provided.

- Your insurer also has to treat you fairly in all interactions following the Treating Customers Fairly (TCF) regulatory requirement. This includes but is not limited to, how their products are designed, the advice they give, how they handle your claims, your complaints, etc.

What to do if you feel like you’re being cheated by your insurer

If you’re unhappy with your insurer and the way they’ve dealt with your policy or claim, there are specific ways to raise and escalate a complaint.

First, start a paper trail

First things first, you need to lodge a formal complaint with your insurer. This should generally be done in writing to create a paper trail. Try to write a clear, concise email that follows a logical sequence, and mentions dates of relevant events. From there your insurer will begin an investigation and contact you accordingly to try and resolve the issue.

If you are not happy with the response, contact the Ombudsman

If you are still unhappy with the response after contacting your insurer, you can send your complaint to the Ombudsman.

Who is the Ombudsman?

The Ombudsman for Short-Term Insurance is a service provider created to help resolve disputes in the South African short-term insurance world. The Ombudsman serves as a mediator between the policyholder (you) and the insurance company.

Once the Ombudsman has received your complaint, they will notify you and your insurance company. They will also let you know if they need any more information regarding the dispute. After the insurance company has responded to your complaint, you will also be required to respond. From there the Ombudsman will decide whether to rule in your favour or that of the insurance company.

Use review platforms to leave feedback for future policyholders to see

Use platforms like Hellopeter, Google Reviews or Facebook to complain about your experience with the company. This could help future customers make their decision to buy insurance. But also feel free to leave positive reviews – it not only helps the company know that they are doing a good job but also helps future customers.