Can you let anyone tow your car? Here’s what you need to know.

Car accidents happen. And sometimes you’re left with a car that’s not drivable. It’s stressful and you’re often unsure of what to do, who to call or who to accept help from. Here are a couple of tips to help make sure your car is towed by the right people.

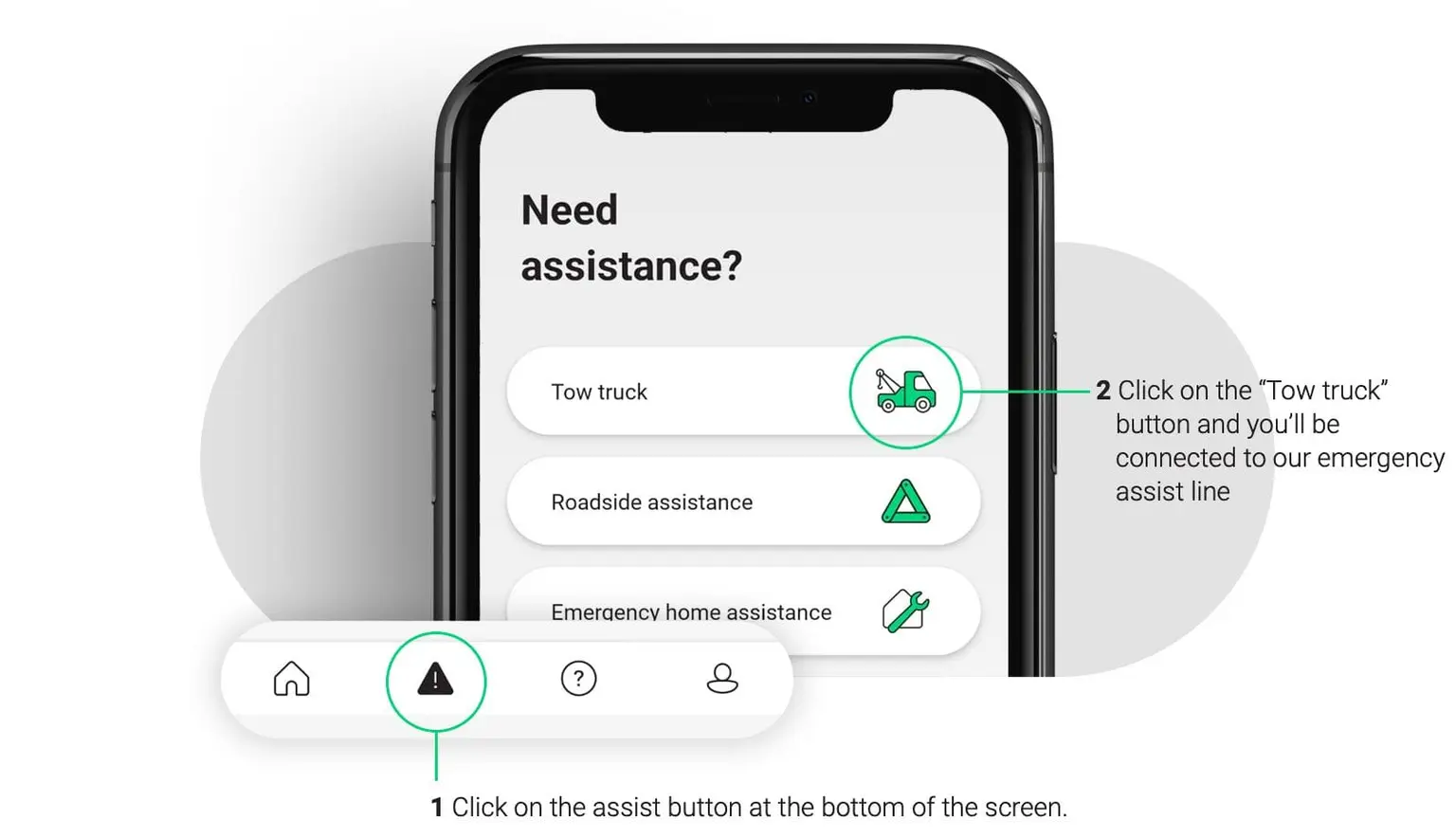

If your car is not drivable, call your insurer so that they can arrange a tow truck driver to tow your car.

Most insurers have a 24/7 emergency assistance line that you can call if you have been in an accident. Once your insurer has all the details of where you are, a tow truck driver will be sent out to you. Make sure you get details like the tow truck’s licence plate, the name of the driver, and an estimated arrival time.

Remember: Just because your car can start, doesn’t mean it’s necessarily ok to drive. If you’re worried the car is not ok, rather don’t drive it – you could cause more damage.

If your car does end up with a random tow truck driver, don’t pay them for any towing services. Rather let your insurer know so that they can help you.

Although tow truck drivers are theoretically not allowed to tow your car without your permission, things can happen very quickly and if you’re not careful, your car can end up with a tow truck driver that your insurer hasn’t approved. This means that you might be responsible for paying both the towing fees and storage costs. If this does happen, don’t just pay for the bill, rather pass the invoice onto your insurer and let them help with the process.

If your car does end up with a random tow truck driver, don’t pay them for any towing services. Rather let your insurer know so that they can help you.

Although tow truck drivers are theoretically not allowed to tow your car without your permission, things can happen very quickly and if you’re not careful, your car can end up with a tow truck driver that your insurer hasn’t approved. This means that you might be responsible for paying both the towing fees and storage costs. If this does happen, don’t just pay for the bill, rather pass the invoice onto your insurer and let them help with the process.

If other people involved in the accident need a tow, it’s best to let them sort it out on their own.

Of course, health and safety should always come first so make sure that you’re both physically ok and out of harm’s way. However, it’s important to let the other person take care of their own towing arrangements. You can help them by telling them that they need to call their own insurer but there’s not much else that you should do from your side. Just make sure you’ve gotten all the right details from them before you leave the scene of the accident. Here’s more info on what to do if you’ve accidentally bumped into someone.

If you’ve broken down because of a mechanical/electrical fault, you can contact your insurer’s emergency assist line, but there is usually a cap on how much of the tow they will cover.

You can contact your insurer’s 24/7 emergency assistance helpline and request their help. Just double-check what their policy is when it comes to breakdowns due to mechanical/electrical faults. Some insurers will have a cap on what they will cover – either the cost of the tow (e.g. R500) or the number of kilometres per tow (e.g. 25km). Insurers generally won’t cover the repairs or replacements when it comes to mechanical/electrical issues.

If your car is still under warranty, you can contact your car manufacturer and they should send a tow truck driver out to you.

There are many benefits to having car insurance and having access to emergency assistance is high up on that list. It never hurts to have that safety net in place, especially if you spend a lot of time on the road – anything can happen.

If you’re new to car insurance, we’ve made it super simple and easy to buy. Just hop onto our app or website and grab a quote in 90 seconds. If you like the price, you can buy on the spot without speaking to a single call centre agent.