All your third party accident and claim questions answered.

You’re inching forward in bumper-to-bumper traffic, but your car moves before the one in front of you does — and suddenly, you’ve bumped a two-million-Rand Range Rover. Your heart sinks, but then you remember you have third party insurance. Phew! But what now? Do you claim? Do they claim? Who’s responsible for what? We break it all down here.

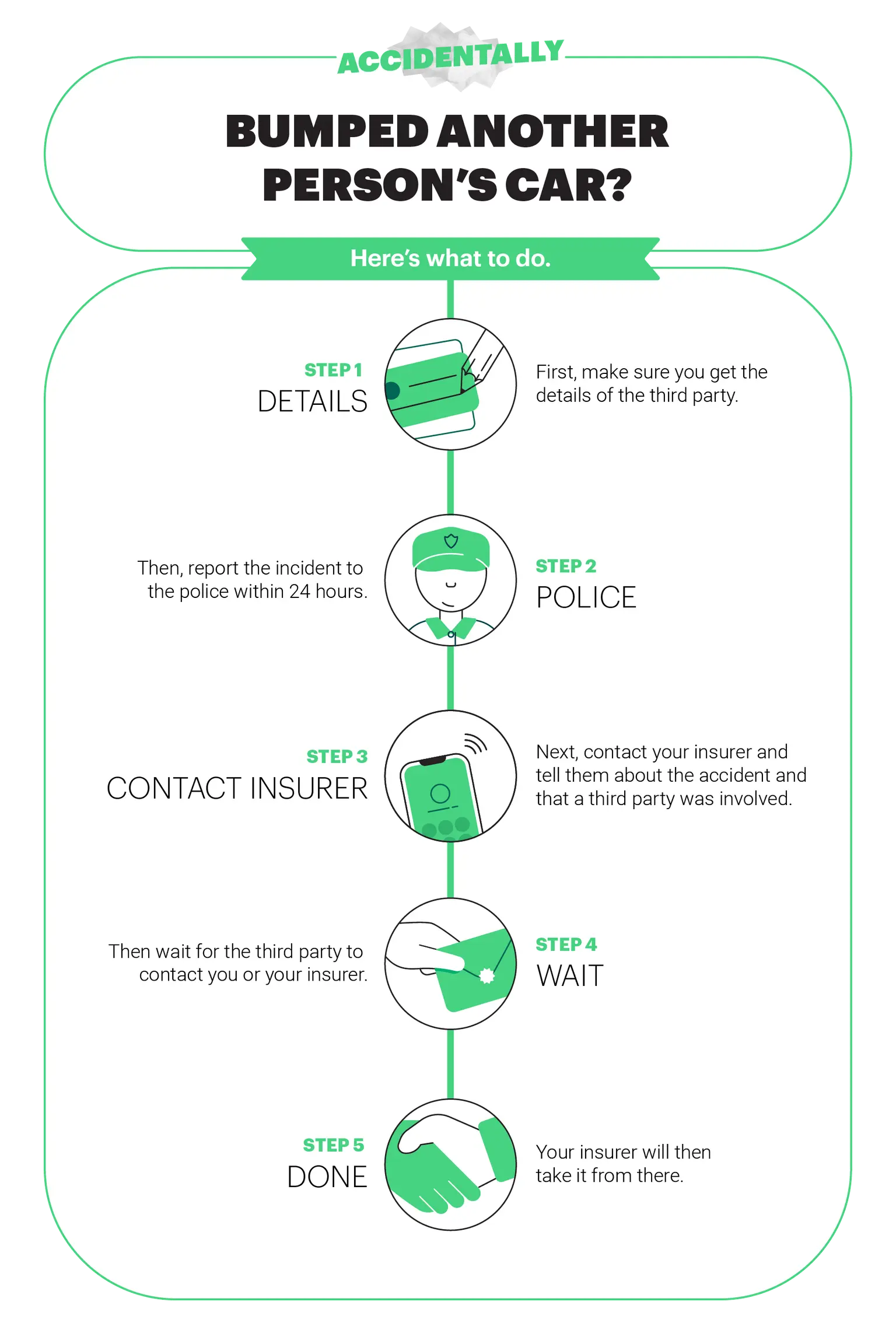

First, make sure you get the details of the third party

Make sure you grab as much information as you can while the person is there in front of you. Take a couple of photos/videos as evidence, get their contact details and whatever else you might need to file a claim. If you’re unsure what info to get, here’s our guide to what details to collect after a car accident.

Then, report the incident to the police within 24 hours

This step is legally required, even if the damage seems minor or you agree to settle privately. According to the South African Road Traffic Act, you must report the accident to the police within 24 hours. Make a note of the case number and take a photo of the completed report while you’re at the station.

Luckily if you have comprehensive or third party only car insurance, your insurer is there to help once you have all the info together.

Next, let your insurer know what happened

Even if you decide not to claim for your own damage, you still need to tell your insurer when an accident involves a third party. This is because:

- The third party might contact your insurer directly.

- Your insurer needs the full picture to handle any claims made against you.

Then wait for the third party to take action

You don’t need to reach out to the third party. They may contact your insurer directly or approach you — but the next step is theirs to take. Here are the most common routes they might follow:

- Fix the car themselves, then contact you (or your insurer) to recover the costs — they might even take legal steps to do this.

- Leave the damage as-is, to keep evidence of the accident and contact you (or your insurer) to request payment for the damage.

- Claim from their own insurer (they pay their excess), and their insurer might contact your insurer to recover the full cost. If successful, they may get their excess refunded.

Your insurer will then take it from there

Your insurer will look at the details of the accident — what you and the third party reported — and decide whether the third party’s damage is covered. If it is, they’ll take on the legal responsibility for settling the claim with the other driver.

If your insurer finds that you weren’t responsible, they’ll challenge the claim on your behalf.

And if you only have third party insurance (not comprehensive), remember: your insurer will help with the other driver’s damage, but not your own.

Thinking of asking the other driver to pay your excess? Hold off for now.

If the accident wasn’t your fault and you're claiming from your insurer for damage to your car, you might be tempted to ask the other driver to pay your excess directly. It feels like a fair ask, but it could actually backfire.

Sorting things out privately, especially before your claim is authorised, can make it harder for your insurer to recover costs later on. In some cases, it could even affect the outcome of your claim if it limits your insurer’s ability to manage the process.

Rather, let your insurer handle it. Once your claim is approved, they’ll take steps to recover your excess and any other costs from the third party — no awkward conversations needed.

What if the damage to the other car is not covered?

If your insurer finds that the damage to the other car isn’t covered by your policy, then they will step away and you and the third party will have to decide how to proceed. This might happen if you were doing something illegal at the time of the accident, like driving under the influence of alcohol.

What should you do if they do not contact you or your insurer?

The short answer is nothing. The third-party might have decided to repair the damage themselves or their insurer might have decided that the details of the accident mean that they can’t claim their loss back from you.

What happens if you know the third party?

Let’s say you’ve reversed into your kid’s ballet teacher’s new Merc, and she’s livid. “How could you do that?! Give me your insurer’s details!”

As much as you might feel like saying “I’ll pay for it” or “I’ll sort it out”, it’s best not to admit fault or offer to cover any costs directly. Doing so could affect how your insurer is able to handle your claim, and in some cases, could even prejudice it.

Here’s what we suggest you say:

- “Is everybody ok? It’s important to get that sorted first.”

- “It seems as though there is some damage to your car – let’s exchange details. Here are my contact details and the details of my insurer.”

- “Can I please get your details and your insurer’s too?”

- “Let’s take pictures of each other’s driver’s licences so we have ID numbers sorted.”

- “Oh and by law we also need to go and report this to the nearest police station within 24 hours.”

- “If you want to discuss how to take this forward, it would be best to contact my insurer directly. I will make sure they know about what happened.”

- “I’ve also heard that the quickest way to get your car sorted is usually to just claim from your insurer. Then the insurers can sort out the details of who is responsible for what.”

Try your best to avoid awkward discussions or blame sessions – let the insurers do the talking. After all, it’s why you have the cover.

Third party insurance is the bare minimum type of cover every driver should have. It protects you from the potentially massive costs of damaging someone else’s car, which could otherwise leave you paying off something you don’t even own.

And the best part? It’s also the most affordable car insurance you can get. Just a few cappuccinos a month — although, sadly, less tasty.