Curious what it costs to insure a Suzuki Swift in South Africa? We break down model prices, what affects premiums and how to keep yours low.

We all know the Suzuki Swift has a massive fanbase in South Africa. It’s a favourite among city drivers, young professionals and first-time car owners. Small enough to zip through traffic and easy to park, the Swift is well-built with modern safety and everyday comforts. So when it comes to your car insurance premium, what should you realistically expect to pay?

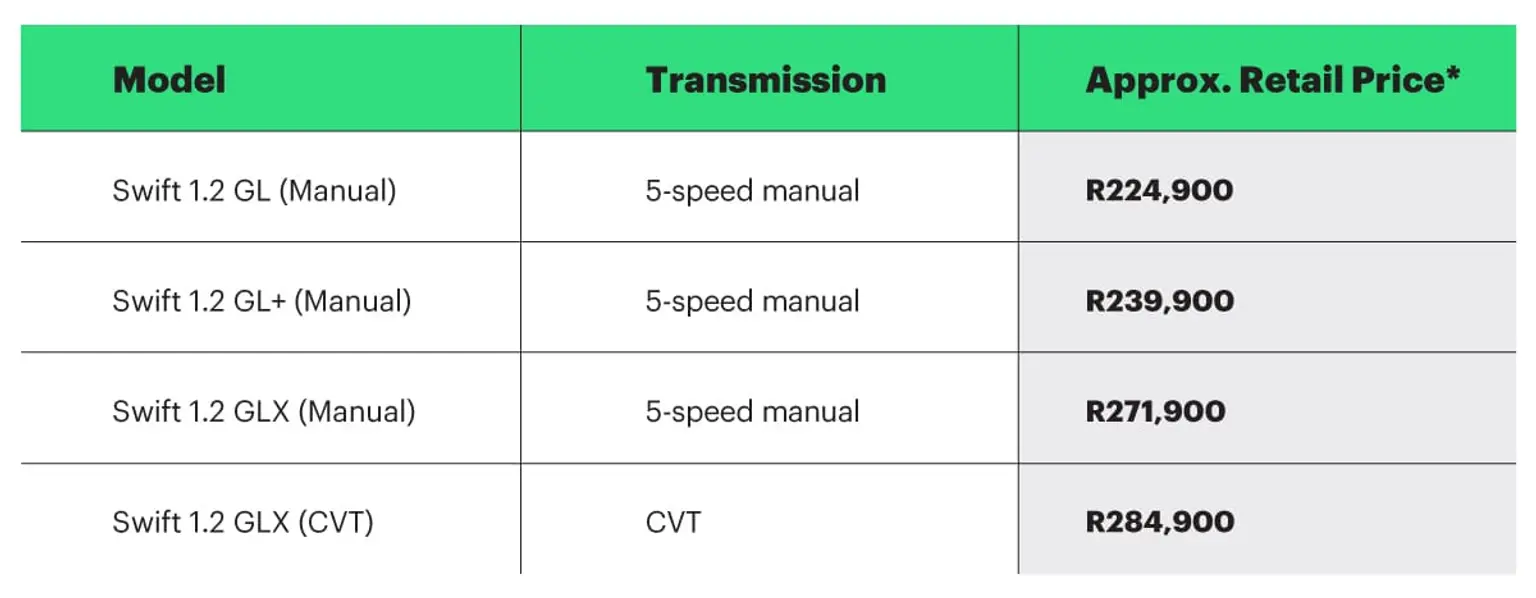

What does a new Suzuki Swift cost in South Africa?

Before we get into insurance costs, it’s worth knowing what the Suzuki Swift itself sells for. Here’s a breakdown of 2024 and 2025 prices for the different models available in South Africa:

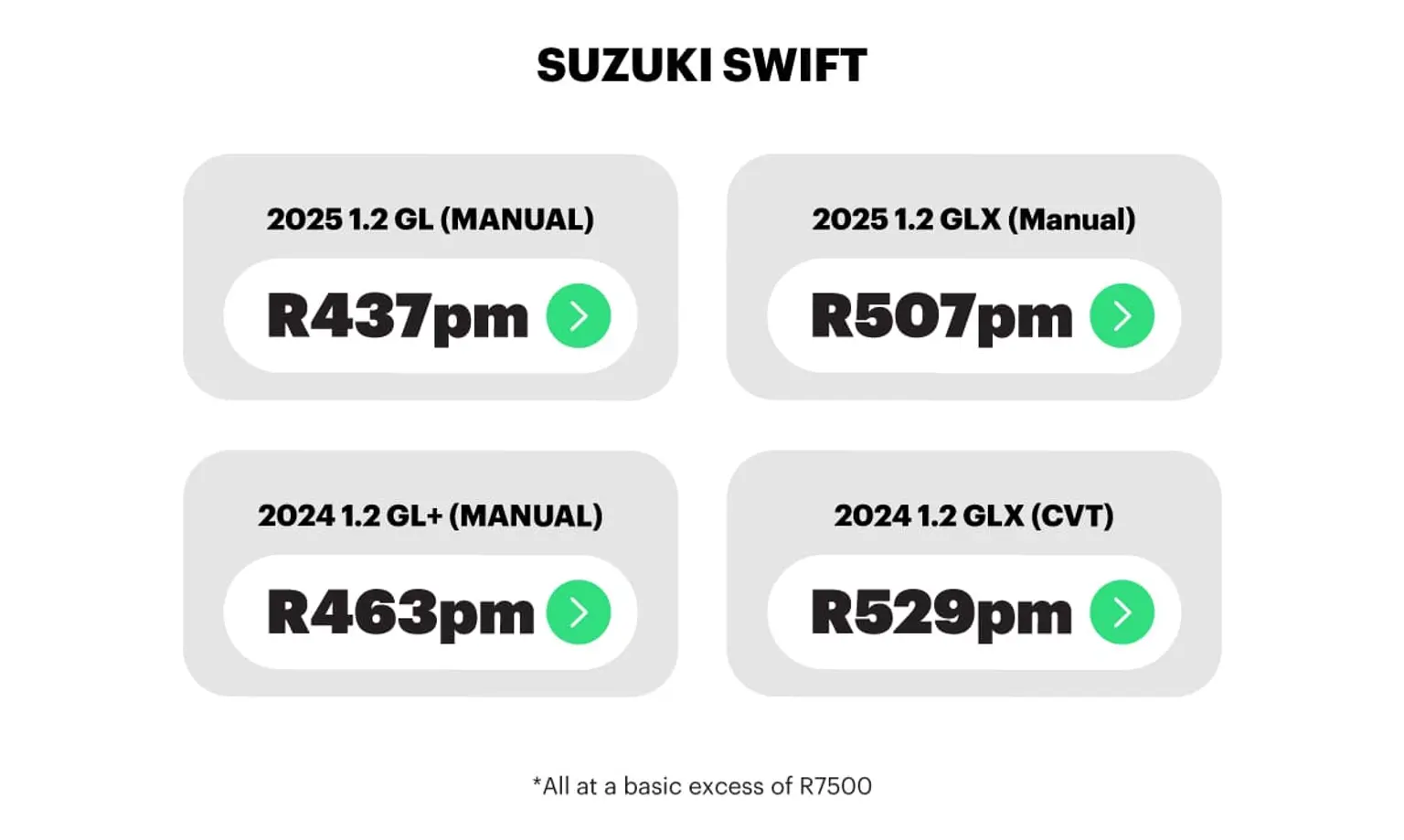

What does it really cost to insure a Suzuki Swift in South Africa?

Car insurance costs differ across the Suzuki Swift range – not every Swift will be priced the same. Entry-level, lower-spec versions typically come with lower premiums, while higher-spec trims tend to cost more to insure because of their added features and higher replacement costs. Because of its higher value and additional tech, the GLX CVT is usually the most expensive Swift in the range to insure.

If you want your actual number, not just a range, you can get a final, binding car insurance quote in 90 seconds on the Naked app or website. No waiting for a callback, just your personalised premium upfront.

What will influence your Suzuki Swift’s insurance premiums?

There’s no one-size-fits-all price tag when it comes to insuring a Suzuki Swift. Insurers look at a mix of factors, from the model you drive to how often and for what you use it. Here are some of the key things that can push your premium up or help keep it down:

Trim and features:

If you go for the top-spec Swift (GLX with automatic/CVT, bigger infotainment, extras), your insurance is higher because parts cost more and the replacement value is higher.

Engine size & usage:

The Swift’s 1.2-litre 3-cylinder petrol engine is friendly on fuel and generally cheaper to insure than larger or turbocharged engines. But driving long distances, in rural or high-risk areas, or using your car heavily can increase costs.

Safety & warranty:

The Swift includes ABS with EBD and stability control. Insurers generally price safer cars lower because they mean less severe claims. A strong 5-year / 200,000 km warranty also helps.

Excess & cover level:

Choosing a higher excess, reducing optional extras, opting for third-party cover instead of comprehensive, or limiting add-ons can lower your premium.

Pros and Cons of owning a Suzuki Swift

Pros:

Excellent fuel efficiency and low running costs

Generally cheaper to insure than larger cars or bakkies

Good standard safety features and modern infotainment

Strong warranty in South Africa (5 years / 200,000 km)

The Swift tends to hold value reasonably well compared to many small hatchbacks, especially if you understand why cars lose value and what you can do about it.

Cons:

Limited space for passengers and cargo (small boot)

Higher-spec models come with more expensive parts and repairs

Extras like automatic transmission, alloy wheels, and premium infotainment raise insurance costs

Resale value of fully specced models may not always justify the added spend

What can I do to lower my Suzuki Swift insurance premium?

Fit safety and security features like tracking devices or alarms.

Use secure parking.

Choose fewer luxury extras.

Keep up with servicing and recalls.

Opt for a higher excess if you’re comfortable with it. If you’re not sure how excess works or how it affects your premium, here’s everything you need to know about car insurance excess.

Be honest about how you use the Swift: if it’s mostly for city commuting rather than long-distance or rural driving, make sure your insurer knows.

How does Naked make insuring a Swift simpler?

Naked takes the hassle out of car insurance. Get a final quote in under 90 seconds, sort your cover in the app, and grab proof of insurance that’s ready for your bank right away. Change your excess whenever you like, switch accident cover off when your car’s parked, and handle your claims straight in the app. Simple, flexible, comprehensive cover, with roadside assistance and towing built in.

FAQs about insuring a Suzuki Swift in South Africa

Why are Swift premiums usually lower than bigger or more powerful cars?

Because the overall risk and potential payout are lower. The Swift typically costs less to buy and repair, has a smaller engine that’s less likely to be driven hard, and in many cases isn’t as high on theft-priority lists as certain bakkies and high-end models.

Which Swift model is the cheapest to insure?

The base GL manual, with minimal extras and all the standard safety gear included, is your least expensive option.

Are there issues specific to the Swift that could affect my insurance premiums?

Yes. While Swifts are usually cheap to insure, some factors can push premiums up. Certain models or years may be more popular with thieves, and heavily modified Swifts (lowered, mags, sound, performance upgrades) can cost more to insure. A young or inexperienced main driver, or using the car daily in heavy traffic or higher-risk areas, can also increase what you pay.

Do location and parking impact insurance costs?

Yes. Staying in a safer neighbourhood and keeping your car in a secure garage can noticeably reduce your premium compared with parking on the street in higher-risk areas.