Steps to follow for the best chance of getting your car back and how to claim from your insurer.

Although we don’t hear about it on the news, car theft is quite common in South Africa. According to SAPS annual crime stats, almost 128 cars and motorcycles were stolen a day in 2019/2020.

We like to think that we’ll never be part of a statistic like car theft, but the unfortunate reality is that it’s very possible. Knowing what to do when you find an empty parking spot where your car used to be can ease the panic, and help you navigate this stressful event calmly.

Your car has just been stolen. Here’s what you need to do and know in order of importance:

1. Immediately activate your tracking device

Depending on your type of device, you could activate it yourself or you might need to call your tracking company to get it done. Either way, give them a call to make sure they are aware of the theft. Remember to also ask for regular updates so that you can let the police know the status of the search.

2. Report your car stolen to the police

Do this as soon as you can. The police will open a case and flag your car on their stolen vehicle database. Border crossings and roadblocks have access to this database and your insurance company should be able to access it as well.

You’ll need to give the police specific details like your licence plate number, VIN (Vehicle Identification Number, which you can find on your vehicle registration documents), the make, model, colour of your car and details of your tracking company, if you have one.

They will also ask where and when you last saw your car and whether it has scratches, dents, marks, or any other unique features that may help them identify your car on the road.

3. Report your car stolen to your insurance company

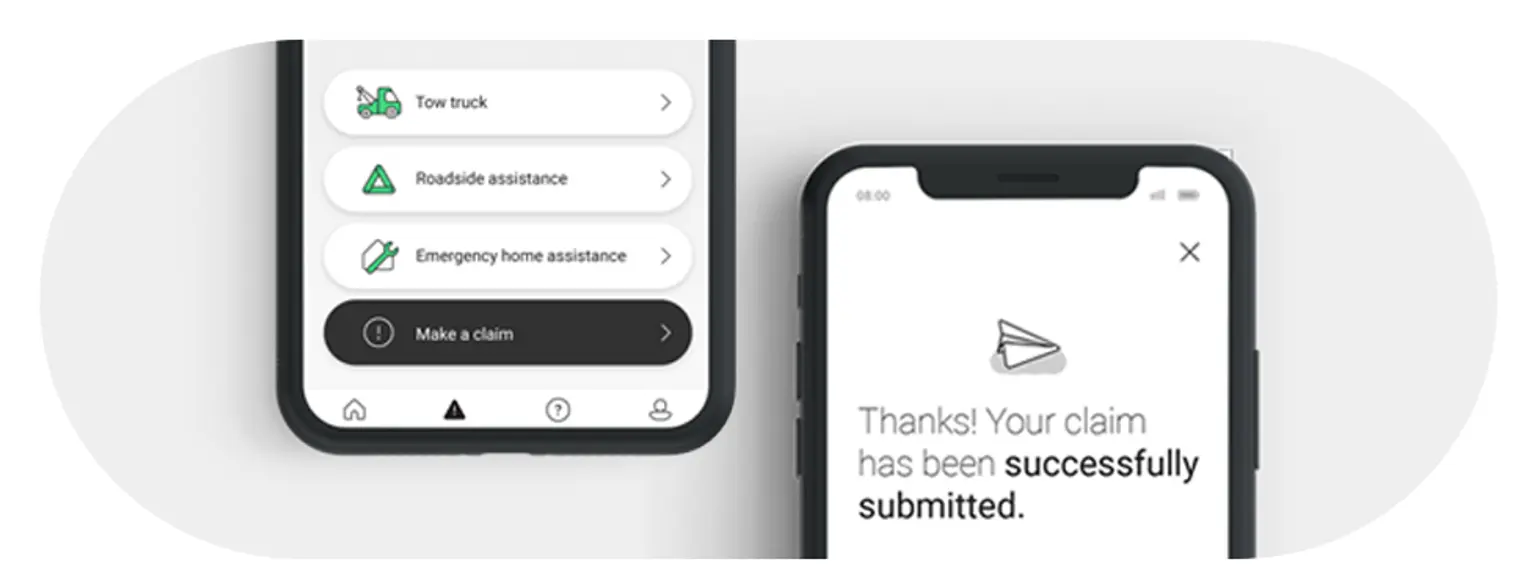

The sooner you let your insurance company know about your car being stolen, the better. This will set the claims process into motion and get you back on the road as soon as possible.

Your insurance company will usually need:

- Details of the time and place you last saw your car

- Any unique features it might have

- A picture of the police report

- The police case number

- A copy of the vehicle registration documents

- Certified copy of your ID

- A consent form that gives them permission to access the police records and border movements for your car

- The notification of change of ownership form

- Photos of the full set of keys for your car

- Tracking information (if you have a device installed)

- Details of the last service

- Mileage of your vehicle

- Description of any marks, dents or scratches

After your insurer has received all of the information about your car they will start processing the claim.

Unfortunately, without a tracker installed, the chances of getting your car back are pretty slim. The current recovery rate of stolen vehicles without trackers in South Africa sits at 5-10%, according to Tracker’s Ron Knott-Craig, whereas 80% of cars with trackers are recovered. Either way, getting these three steps done as soon as you can will improve your chances of getting back on the road ASAP.

Remember: If you have car hire added to your policy, your insurer will set you up with a hired car to help you get around for the time being.

The next step is for your insurer to settle the outstanding amount on your car loan

Once your claim has been given the all-clear, your insurer will ask you if you have an outstanding loan with a finance house. If you do, you will need to request a settlement letter from your bank and forward it to your insurer. From there, your insurer will prepare the agreement of loss document which tells you how much will be paid to you and/or your bank.

You’ll need to sign the agreement of loss document and send it back to your insurer along with your car keys and the original registration documents.

Please bear in mind that your insurer legally has to settle the loan first before paying any remaining amount to you.

The amount paid out will be the value of your car minus your excess. The amount you receive will depend on whether your insurer has insured your vehicle for trade, market or retail value.

Other useful info to help you cope

1. What if the car is found during the claims process?

Sometimes, cars are found and recovered whilst you’re in the process of claiming. If this happens, either the police or the tracking company will let you know and you will then have to let your insurer know.

You will need to get a clearance certificate from the police to get your car taken off of the stolen vehicle database. Otherwise, you might be pulled over in your own car and have the police think you stole it!

It’s quite common for stolen cars that are recovered to come back damaged as they are usually stripped. If this happens to your car, report the damages to your insurer. The claim should then proceed as a damage claim rather than a theft claim.

2. What if the car is found after the claims process?

If your stolen car is recovered after you have received your payout, the car will belong to your insurer. However, if any of your property was found in the car, it will be returned to you.

3. You can try to take things into your own hands to increase the chances of recovery (to a certain extent)

Some thieves are not as clever as others and you might just get lucky by looking for your vehicle on online marketplaces such as Gumtree and OLX. Social media can also be a good place to hunt for your car. If you do get lucky and find something, alert your insurer and the police immediately – they will take it from there.

4. Your car insurance doesn’t cover other valuables like your laptop that were in your car. You’ll need either home contents or single-item insurance for that

Having your car stolen is horrible but it can be even worse if your brand-new laptop and leather bag are stolen along with your car. Car insurance generally doesn’t cover these items so you would need to specifically insure these items under contents or single-item insurance.

If you have cover and important valuables were stolen along with your car, tell your insurer ASAP. Your insurer will ask for the usual details about your belongings as well as a picture of the police report.

If other important documents/information like IDs or credit cards were inside your car, notify your bank and other providers as soon as possible.

5. What do you do if the stolen car isn’t your car? (i.e. it’s a rental car/family/friend’s car)

If you’re using someone else’s car and it is stolen whilst in your possession, the first thing to do is alert the police. Next, contact the owner as soon as you can and they can help you alert the tracking company.

The owner will then be the one to contact the insurance company.

Driving off into the sunset

If there’s a silver lining to all of this, it’s shopping for a new car. You might decide it’s time to downsize or to have your YOLO moment and splash out on your dream car.

Having a car stolen can be heartbreaking and there is a lot of admin involved, but if you are insured with Naked you can be sure the claims process will be quick and easy.

If you’re not part of the Naked family yet, download the app and get a final quote in 90 seconds.