What amount to insure your phone for, what an excess is, what’s covered; all your burning questions about cell phone insurance answered.

There are many question marks when it comes to whether you should insure your cell phone or not. Is my phone covered when I leave the country? Is it worth getting cover for cracked screens? What excess will I have to pay? These are good questions — cell phones are an important part of our daily lives.

Below we’ve answered the most common questions we’ve seen from people thinking about insuring their cell phone:

Here are a few questions we think are important when considering cell phone insurance:

When does it not make sense to insure your phone?

Your contract is almost ready to be upgraded — lucky you!

When you know you’re going to be getting a new phone and will have no use for your current one then it’s not worth getting it insured.

You have a workable phone in your drawer.

You have a spare phone without any bumps or bruises (including its battery life) that you could pull out and use it if something happens to your current one.

You can afford to buy a new cell phone (in cash).

Some of us keep our phones for years, while others replace them every two years. Whichever way you do it, having the money for a new phone can mean you don’t have to insure your current one.

If you didn't think, ‘Ha, that’s me’ when reading the above, then it’s probably worth getting insurance.

If I am insuring my phone, what amount should I insure it for?

If it’s a new phone, this part is easy! Just have a look at your receipt to see how much the phone is worth or you could check out takealot.com to find the price — be sure to look at the right phone model and the correct storage. This is generally the amount you’d insure your phone for.

My phone isn’t new — what should I insure my old(ish) phone for?

If it’s an older phone, you may have to do a bit more digging to find the price it’s being sold for, new. Why? Cell phone insurers cover you for the replacement value of your phone — what it would cost to buy your phone new – not what you originally paid for it.

When your model has been discontinued and is no longer being sold new, then it’s best to insure your phone for the price of a similar model.

You should also avoid insuring your phone for less than what it’s worth.

Let’s say you bought your phone three years ago for R8,000 and you now want to insure it. Intuitively, you might want to insure it for its depreciated value. It’s a couple of years old — why should you pay a premium for a new phone you don’t have?

But, if something happens to your current phone, it’s beyond repair, your insurer would either replace it with the same model or a similar one — NOT a second-hand one. This is why insurers tend to require you insure your phone for its current new price no matter if it’s new or old.

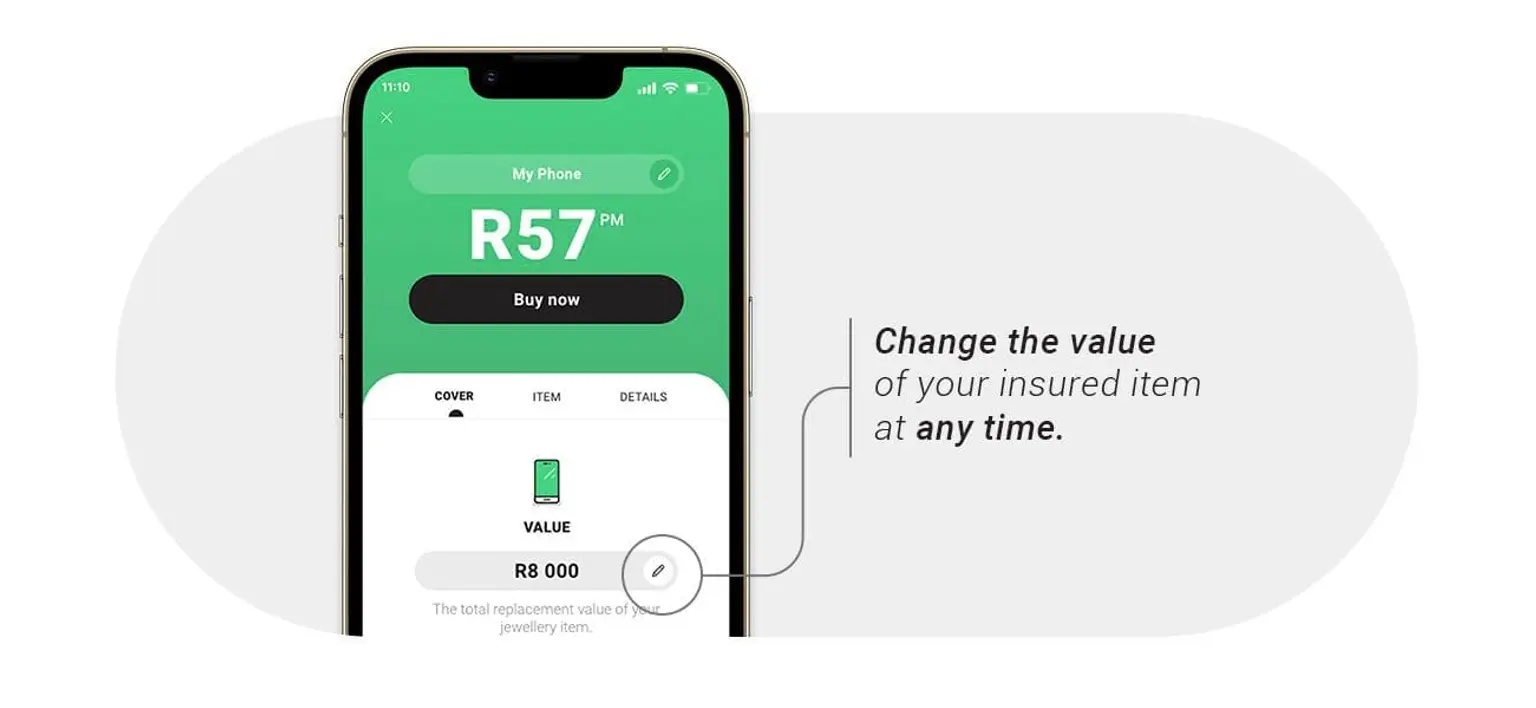

Should I update the value of my phone from time to time?

Updating the insured value of your phone regularly is a good idea. It ensures that you have the right amount of cover but also that you are not overpaying on your monthly premium.

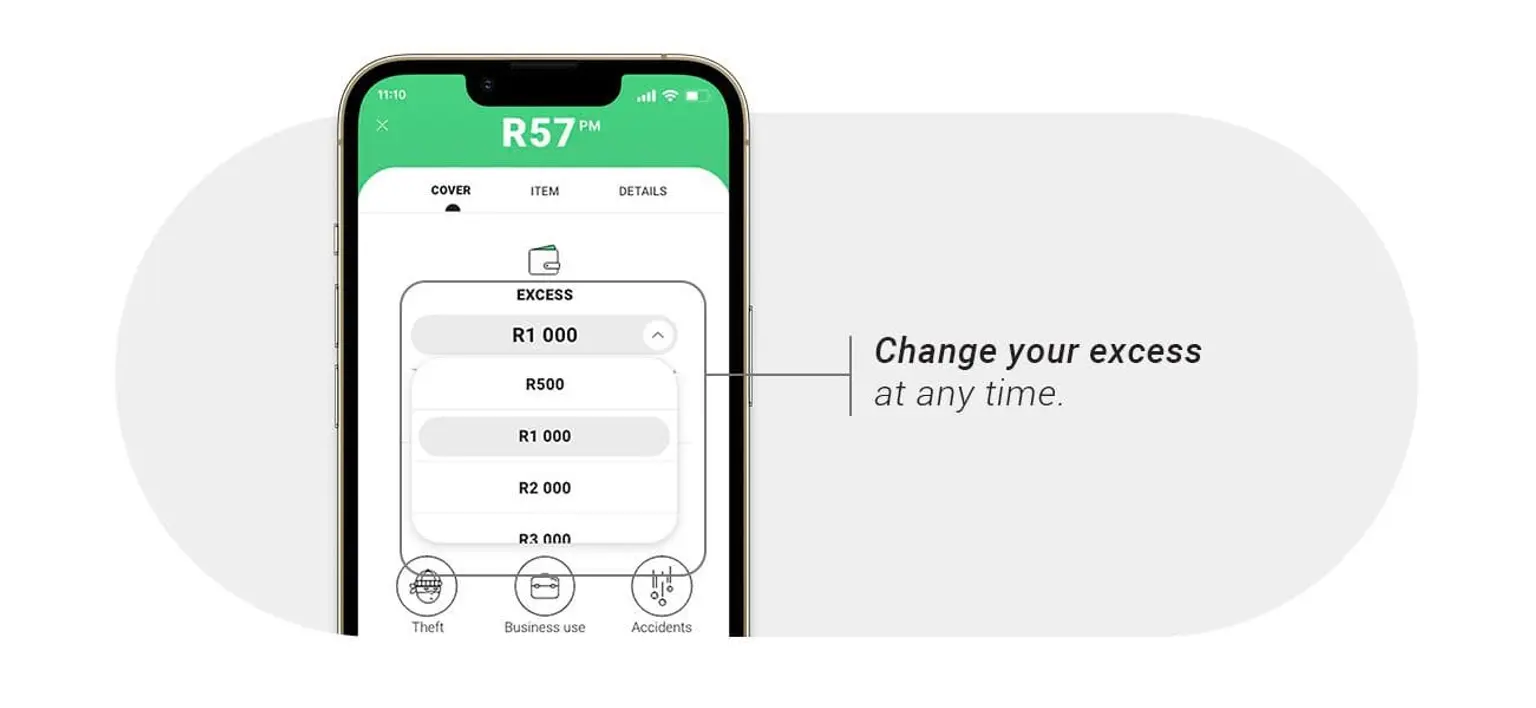

What excess should I choose?

First let's look at how excesses work

An excess is the amount of money that will come out of your pocket when you claim. If, for example, you have a R1,000 excess and your R10,000 phone is stolen, your insurer will pay R9,000 and you’ll pay R1,000.

Excesses on cell phone insurance come in two flavours: percentage excesses (like 15%) and flat excesses (like R1,000).

A percentage excess of 15%, in the example above, would mean that you would be on the hook for 15% of the value of the claim i.e. R1,500 while the insurer would pay R8,500.

How should I choose my excess?

The higher your excess the lower your insurance premium will be and vice versa.

So how to choose? The easiest way to calculate the best excess is to determine the amount you can comfortably afford to pay out of your pocket if and when you need to claim. This means you’ll avoid getting into trouble when it comes to claiming while minimising the amount you have to pay for insurance.

Questions to ask when looking at insurance for your cell phone

Are cracked screens and other accidental damages covered?

We all know the feeling of our phone slipping through our fingers — it’s the worst. Check the policy whether damaged screens and other accidental damage is covered.

Am I covered if my phone stops working?

General wear and tear isn’t covered by cell phone insurance. However, most phones come with a manufacturer's warranty (usually 24 months). So if your phone suddenly bombs out (given that you haven’t damaged it yourself), this warranty will usually cover your phone.

Am I covered for water damage?

Talking on the phone whilst doing dishes and having your phone slip into the water usually means it’s game over for your phone (and your conversation). Check out the policy to see whether water damage is covered.

What if I lose valuable data — am I covered?

In the case of your phone getting stolen or damaged, the cell phone will be covered but typically, the important data such as your favourite photos or contacts that are stored on it won’t be. Luckily, nowadays with phone software like Apple iOS and Android, you can easily store your data in the cloud.

Does my cell phone insurance cover me outside South Africa?

It doesn’t matter where you are in the world, phones can still break or go walkabout — check your policy to see whether you’re covered worldwide.

How does claiming work on cell phone insurance?

If something unfortunate happens to your phone, it’s best to get ahold of your insurer as soon as you can. They’ll want to know all the details. Things like:

- A full description of what happened

- Exact details of the cell phone you are claiming for

- Proof that you owned the cell phone, usually in the form of a receipt

- When the event happened (time and date)

- Where the event happened (exact address)

- A police case number and report in the case of a theft

- An affidavit if you’ve lost your cell phone

- Pictures/videos of the damage or theft

- Any contact numbers of possible witnesses

- Any other proof that you may have of the loss or damage occurring

The more information you give your insurer, the easier and quicker it will be for them to understand what happened, and get you back to scrolling Instagram ASAP.

Next, your insurer will check your cover details and put a value on your loss

An assessor will be assigned to your claim. They will check all the details to make sure that everything checks out. Assessments might take a while to complete as the assessor needs to write up a report, get quotes for replacement or repair and do all the necessary checks before a decision is made.

At this point, your insurer will either reject your claim or go ahead and repair or replace your cell phone

Every insurer is different and so are their processes. They should keep you in the loop on what their decision is.

When might your claim not be paid out?

Unfortunately, there are a couple of instances where your insurer will not pay out your claim – but they will let you know why, setting out all the details, if the decision is made not to proceed. Here are a couple of the most common reasons your claim might not be approved:

- If your premiums are not up to date for the month. Your insurer will insist that the outstanding balance is settled before they will consider any claim

- If the cost of the claim is less than your excess

- If you’re claiming for damage that happened before you took out the policy

- If you’re claiming for something that isn’t covered under your policy. For example, if your phone stops working after a couple years as a result of wear and tear

- If you lied when you took out your policy or when you reported the claim. For example, you lied about your claims history

- If you cancelled your cover before the damage happened, even if the cancellation was done a couple of days before

- If there is evidence of illegal activity (like premiums being paid with dirty money) linked to the claim

It’s your call…

Deciding whether to insure your phone should be quick and easy. If you choose to insure it, it pays to choose an excess you can afford and to make sure you’re covering everything you need. Then you can get on with more important things in life, relaxed, knowing that you won’t have any surprises if something happens to your phone.