Step-by-step process of how to claim on your home and content insurance, and what you can expect at each stage.

When you buy insurance, you’re doing it because you want to protect yourself in case something bad ever happens. But it’s not always clear what to do after something bad does happen.

Here’s a step-by-step process of how to claim on your home and content insurance, and what you can expect at each stage.

First, tell your insurer about the damage or theft

Most insurers will need you to call them, although some, like Naked, will enable you to submit your claim online and then they’ll give you a call afterwards if needed. As this is the first your insurer will hear about the incident, they’ll want to know all of the details, so be sure to be prepared. They’ll usually ask for:

- A full description of what happened

- Exact details of the item(s) you are claiming for

- Proof that you owned the item(s), usually in the form of a receipt

- When the event happened (time and date)

- Where the event happened (exact address)

- A police case number and report in the case of a theft

- An affidavit if you’ve lost an item or items

- Pictures/videos of the damage or theft

- Any contact numbers of possible witnesses

- Any other proof that you may have of the loss or damage occurring

The more information you give your insurer, the easier and quicker it will be for them to understand what happened, and to get you back into the same position you were in before.

Next, your insurer will check your cover details and put a value on your loss

Once your insurer has all the details they need, they will appoint a professional assessor to have a look at the things that you are claiming to determine whether you have cover for what happened. If you do, they will then determine whether your things should be replaced or repaired, and what that would cost.

For small claims, like a cracked phone screen, an assessor will be in touch to arrange an assessment of the item. The item will either be looked at in your home or they will arrange to pick up your item to be assessed at their physical location. Some insurers might also ask you to take your item to an assessment company to have it assessed.

For larger claims, such as a break-in or a fire destroying most of your stuff, an assessor will get in contact with you to arrange a meeting at your home. They will take a look at the damages caused by the event and will get to a final cost of the claim based on their assessment. Part of this assessment includes determining whether items can be repaired or need to be replaced.

The assessment process – for both small and larger claims – might take a while to complete as the assessor needs to write up a report, get quotes for replacement or repair and do all the necessary checks before a decision is made.

Now comes the good part: putting you back in the position you were in before the loss

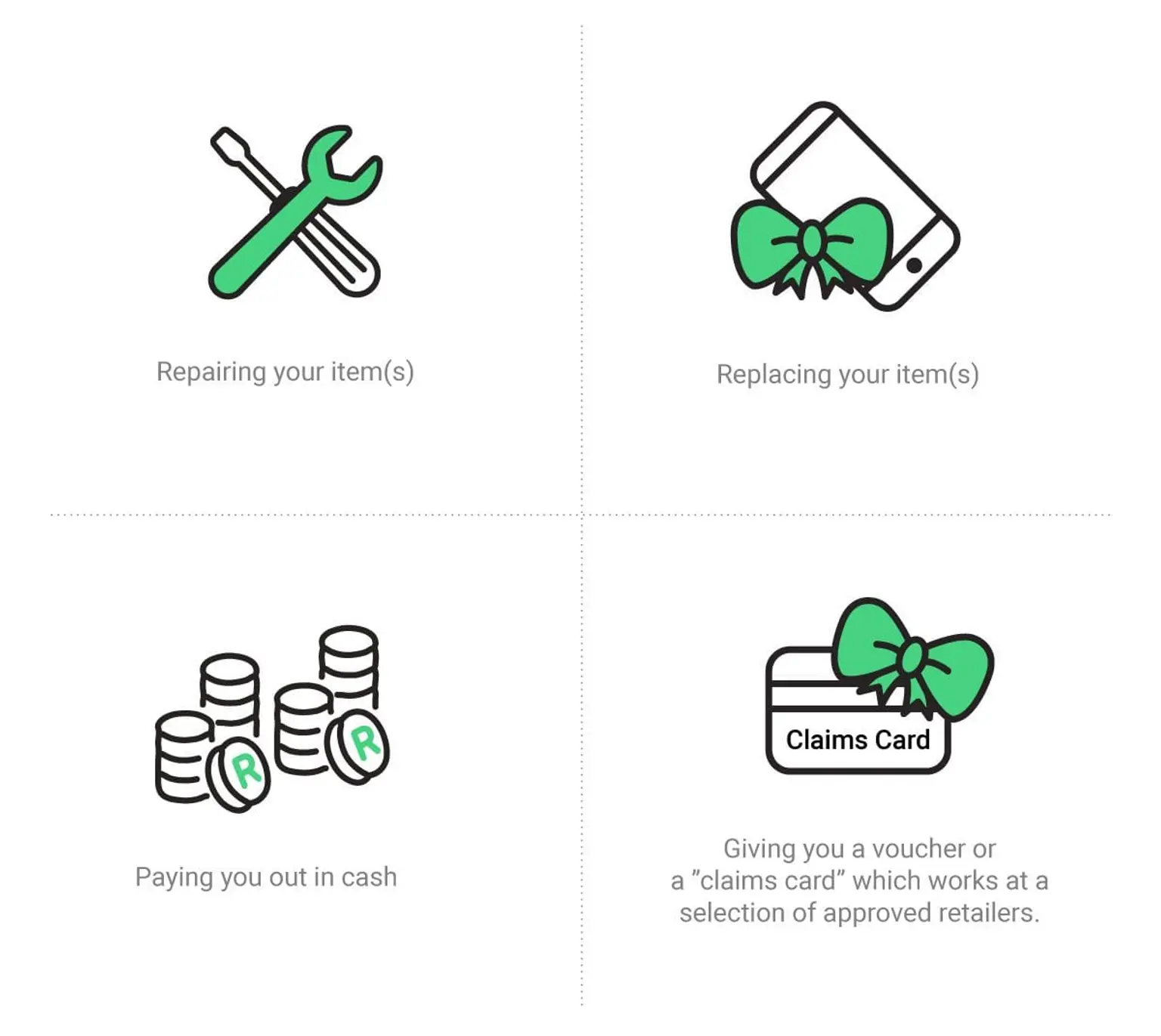

If everything checks out and the loss or damage is covered by your policy, your insurer would then make things right by:

Every insurer is different, so much depends on their personal processes. One thing that is usually consistent, is that you will have to pay your excess before your things are replaced or repaired. The excess is the amount that will come out of your pocket every time you claim on your insurance. When you buy your cover you will be asked to choose your excess, so it’s important to ensure you will easily have the cash on hand when you need it.

When might your claim not be paid out?

Unfortunately, there are a couple of instances where your insurer will not pay out your claim – but they will let you know why, setting out all the details, if the decision is made not to proceed.

Here are a couple of the most common reasons your claim might not be approved:

- If your premiums are not up to date for the month. Your insurer will insist that the outstanding balance is settled before they will consider any claim;

- If the cost of the claim is less than your excess;

- If you’re claiming for damage that happened before you took out the policy;

- If you’re claiming for something that isn’t covered under your policy. For example, if your phone stops working after a couple years as a result of wear and tear;

- If your home is being used as a commercial property to run a business and it causes an event that destroys your property – assuming you haven’t insured your home as a commercial property. For example, if you have a photography studio in your garage and the chemicals in your darkroom catch fire and burn your house down;

- If you lied when you took out your policy or when you reported the claim. For example, you lied about your claims history or what you use the house for;

- If you cancelled your cover before the damage happened, even if the cancellation was done a couple of days before; and/or

- If there is evidence of illegal activity linked to the claim.

How to claim at Naked

If something bad has happened to your things, we want to get you back into the position you were in before the loss as quickly as possible. This is why we have streamlined the claiming process and made it digital. Here are a few steps to follow to claim:

Having to file a claim with your insurer often means that something bad has happened, which is never a nice thing to experience. But we hope that you now have a better understanding of what to expect during the claim process!