Giving a value for your home contents that’s too low means that only a portion of your claim will be paid out, so it’s important to give the right answer.

“How much is all your stuff worth?” That’s the question your insurer will ask when insuring your home contents. It’s a simple enough question, but the answer isn’t always straightforward, and most people give a value that’s 30% too low.

Giving a value for your home contents that’s too low means that only a portion of your claim will be paid out. So it’s important to give the right answer and we’re here to help you do that.

What exactly qualifies as ‘home contents’?

Let’s start by defining what you would insure under a home contents policy. Home contents generally refers to everything you own that isn’t a part of the building. If you had to pick up your home and shake it, everything that would fall out would be your home contents. Things like cars and animals aren’t covered under home contents.

How to accurately value your stuff

Work through your home one room at a time.

Go around the room and make a list of the most valuable things first. And don’t forget about valuables in the garage or things like the automatic pool cleaner.

Next up, specify the replacement value of these items.

In other words, not what you paid for it, but what it would cost to replace as new. For example:

- When valuing something like your couch, you should value it at what it would cost new today. This number is typically higher than what you originally paid for it.

- For electronics, it’s a similar concept to the couch. If your model is no longer manufactured, you should look at the price of the model closest to yours.

For example: Say you paid R12,000 for your iPhone 6 and it’s not manufactured anymore. You then need to insure it for the value of the next model up from yours. If this is the iPhone 7, which is being sold for R10,000, then you need to insure your iPhone 6 for R10,000. But if the latest model is the iPhone 10 and that’s valued at R15,000 then you need to insure your iPhone 6 for R15,000.

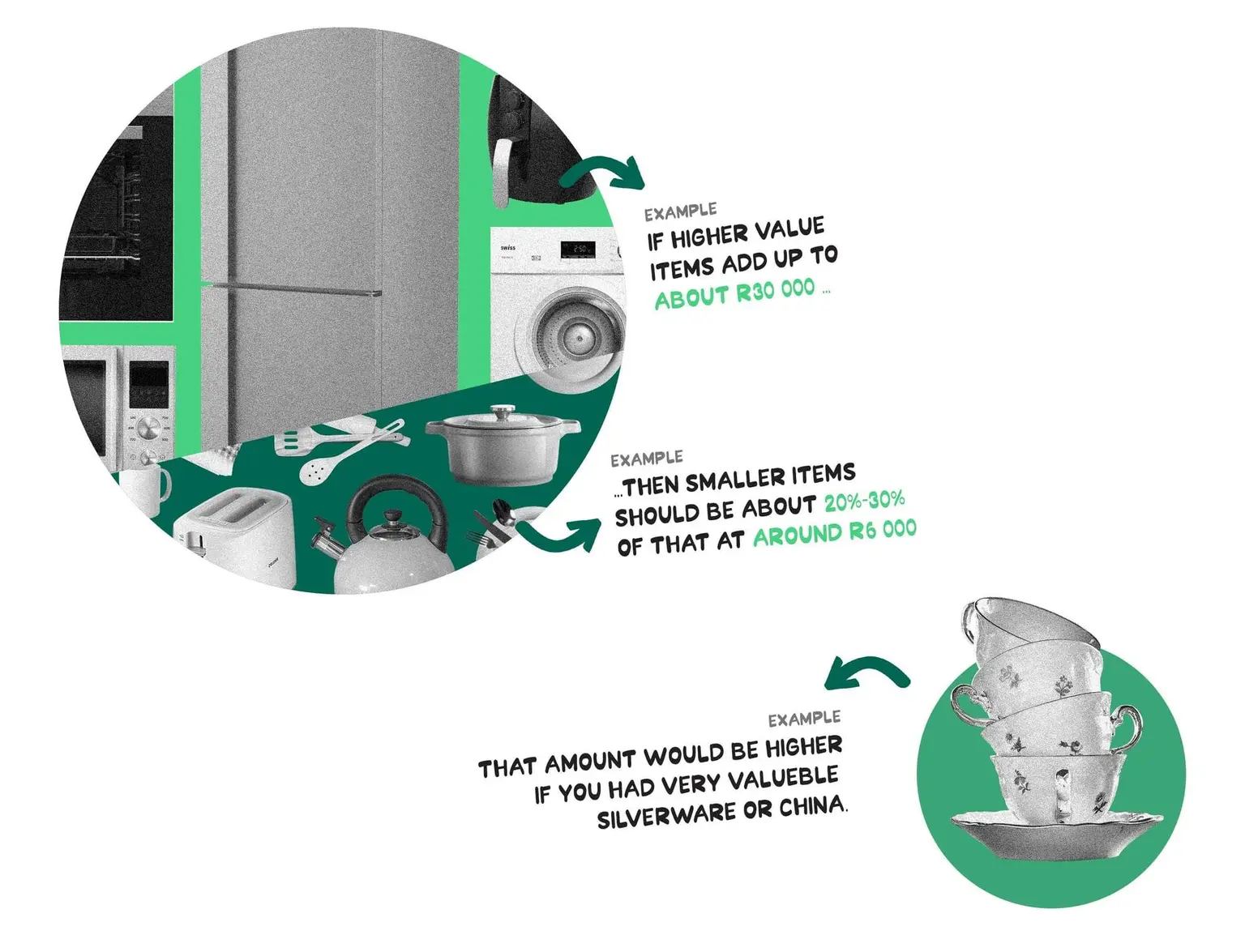

It’s not always easy to place a value on the smaller items you’ve collected over time. Once you have found the replacement value of the higher-value items, add those values up so that you have a separate amount for each room. As a rule of thumb, the smaller items in that room should be valued at 20-30% of the higher-value items. For example, let’s say the higher-value items in your kitchen (the fridge, microwave, washing machine and dishwasher) add up to R30,000. The smaller items in your kitchen should be valued at least around R6,000. But if you have very valuable silverware and china, this would be a much higher amount.

Now that you have an estimated value per room/area, add it all up to get the value of everything you own.

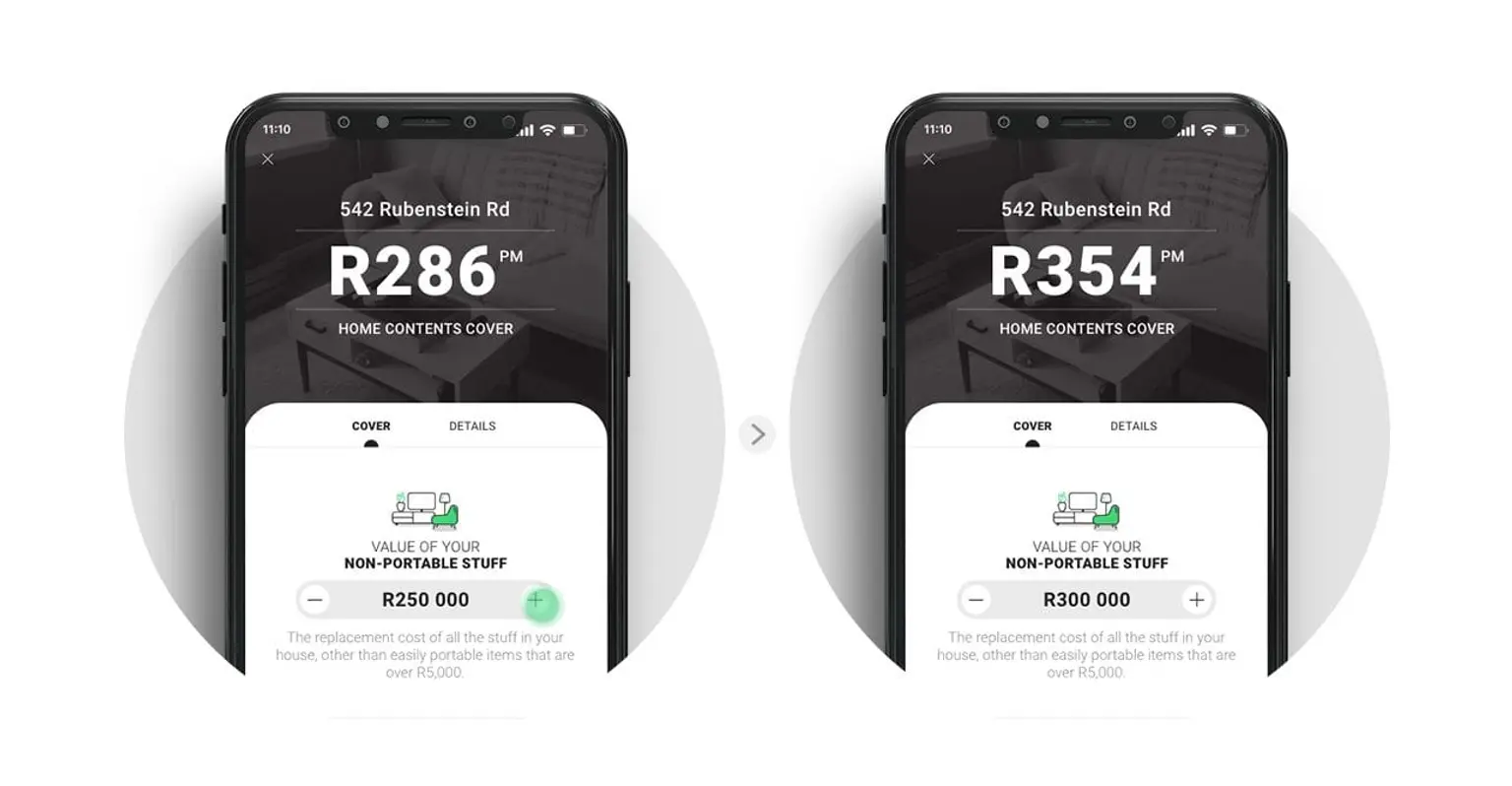

Then we suggest you add R50,000 to that amount. The reason for this is that throughout the year you will buy a couple of new things: clothes, a new toaster or a new bed. To avoid having to update your value every time you buy something, you already have a buffer in place. For example, if all your contents add up to R250,000, make your value R300,000 (R250,000 + R50,000).

Keep your value updated

The value that you give your insurer should be reviewed each year. You may find that you have bought a few valuable items that need cover. But if this isn’t the case, then you should at least consider upping the value with inflation each year — the price of replacing your things will go up as inflation does.

If you’ve come this far, you can see that valuing your stuff accurately is not so hard and doing it right will only help you in the long run. Not doing so might leave you high and dry, which nobody wants! If we haven’t covered something that you still want to know, pop us an email at help@naked.insure 😊