An easy-to-understand guide that explains the different types of insurance that you may need before getting behind the wheel of your car.

Written by Ross Furguson, Naked actuary, AI specialist, and occasional writer.

Crash course in car crash cover

Disability cover, comprehensive car insurance, third party car insurance, funeral cover, personal property cover, medical aid, life insurance, the Road Accident Fund… Trying to piece together the covers you may need to get before getting behind the wheel of your car can be complex and intimidating, to say the least. However, given the possible stress and financial burden that often comes with car accidents, it’s worth taking the time to wrap your head around.

Having done the research myself, I thought I’d save you the trouble and summarise this daunting world of accident cover into an easy-to-understand guide. To help structure the guide, I’ve used three well-known car accidents from movies as case studies.

First up, damage to property

To explain this, I’ve used the drama thriller Changing Lanes, which stars my favourite and least favourite actors, Samuel L. Jackson and Ben Affleck. I’ll leave it to you to guess which is which.

The lead-up to the accident in this film has an all too familiar feeling — you’re rushing through town to an appointment for which you’re already 15 minutes late and it’s as if everyone else is driving slower than normal just to spite you.

In the movie, you can see this sense of urgency on Gavin Banek’s face (Affleck). He’s on his way to an appointment that he’s (you guessed it) late for. Whilst driving recklessly, he botches a lane change and pushes Doyle Gipson (Jackson) off the road and into a crash barrier separating the highway from the offramp. You can see where the movie gets its title from.

Luckily, neither of them is hurt (bar Gavin’s ego perhaps) but both cars are damaged with Doyle’s being totalled.

Gavin flees the scene of the car accident, which puts a plot of turmoil and distress into action: credit scores are hacked, cars are sabotaged and people are falsely accused of kidnapping (you know, pretty standard thriller movie stuff). Needless to say, both of them end up in a not-so-happy place, which could’ve been avoided.

So, at risk of missing the point of the movie entirely, this is how to steer clear of a similar plot ensuing in real life:

If Gavin had third-party car insurance (sometimes called damage to others), he wouldn’t have had to pay large sums of money for the damage he caused to Doyle’s car. Third-party car insurance protects you from the legal liability that arises from you causing damage to someone’s property (this includes the car and contents in the car) as well as the property of local authorities (such as the damage Doyle’s car did to the crash barrier).

A benefit of third-party car insurance that’s often overlooked is the help in dealing with the legal proceedings that may follow an accident — this means you’ll have your insurer in your corner if a legal battle arises. That being said, this cover is only in play provided you haven’t done anything illegal… like leaving the scene of the accident without exchanging details. Not cool Gavin, not cool.

Now if Gavin had comprehensive car insurance, he would have protection against damage to others as well as damage to his own car. This wouldn’t include cover for any damaged contents in his car — he would need home contents insurance for that. However, comprehensive car insurance would’ve covered any damage done to the Tesseract in Gipson’s boot. Wait… that’s not right. I’m getting my Samuel L. Jackson characters confused. While I’m on the topic of Marvel, let’s move on.

Next, accidents that result in injury

Our next car accident unfolds in the Marvel blockbuster Doctor Strange, starring Benedict Cumberbatch It follows the story of Doctor Stephen Strange (Cumberbatch), a world-renowned surgeon, who accidentally drives his Lamborghini off a cliff, and as a result, severely damages his hands. Being dependent on the use of his hands for his work, he does everything he can to try to correct the damage (obviously not himself). Forking out large sums of money for each surgery eventually leaves him broke and still without the use of his hands. Now, all Marvel fans will know that Doctor Strange ultimately does quite well for himself in becoming the Sorcerer Supreme, but this is not always an option in the real world.

Fortunately, in South Africa there is something of a safety net for innocent victims of car accidents in the form of the Road Accident Fund, which South Africans pay for through a fuel levy. This provides compensation for hospital and medical expenses incurred following a car accident and will also replace the loss of income if car accident victims are unable to go back to work. In addition, the Road Accident Fund also provides cover in the form of lump sum payments to compensate people for pain, suffering and disfigurement caused by serious bodily injury (usually referred to as general damages).

So what sort of compensation would Doctor Strange receive were he driving on South African roads? Well, first we need to clarify that the accident was Doctor Strange’s fault since he was distracted by his tablet when he lost control of his car. In its current form, the Road Accident Fund does not provide cover for those who are completely at fault for the accident. Rather, the Road Accident Fund can decide to pay an amount inversely proportional to the road user’s share of the blame. For example, let’s say authorities decided that Doctor Strange wasn’t solely to blame for the accident because there was insufficient signage around the cliff, they might’ve put 60% of the blame on Doctor Strange meaning he gets 40% of the potential payout.

When you take the proportional payments and the caps and limits that are applied to the payouts into consideration, you can see where medical aid and disability cover would’ve helped safeguard Doctor Strange against the cost of medical expenses and loss of income.

Finally, accidents that result in loss of life

Our last car accident takes place in the romantic drama Great Gatsby starring Leonardo DiCaprio (Gatsby), Carey Mulligan (Daisy), Joel Edgerton (Tom) and Isla Fisher (Myrtle). Summarising the twists and turns of this movie's plot is no easy task, but the car accident is considered to be the climax of a number of different character arcs. The climax comes when the entourage is driving back to Long Island and Myrtle, Tom’s lover, mistakes Gatsby’s car for Tom’s and runs out into the street where she is hit and tragically killed. This gut-punching moment has a significant bearing on the tragic ending of the story.

Although just a fictional plot that revolves around love affairs, money and extravagance, the gist of the accident is sadly very real in South Africa. And with that comes other possible realities for those close to the victim.

Let me break it down.

Loss of support to dependants: The Road Accident Fund provides compensation to dependants of victims who die in car accidents to make up for the loss of financial support they would have otherwise received.

Remember, as was the case in the Doctor Strange scenario, the cover provided by the Road Accident Fund depends on who is to blame for the incident. Some caps and limits apply to these benefits and they only provide coverage in the case of accidents that occur on South African roads and not for other events. Additional life insurance products would ensure more complete coverage for the victim’s dependants.

As for funeral expenses, the Road Accident Fund also provides some benefits, but again, additional cover in the form of funeral cover would help with the compensation of funeral expenses.

Before I go…

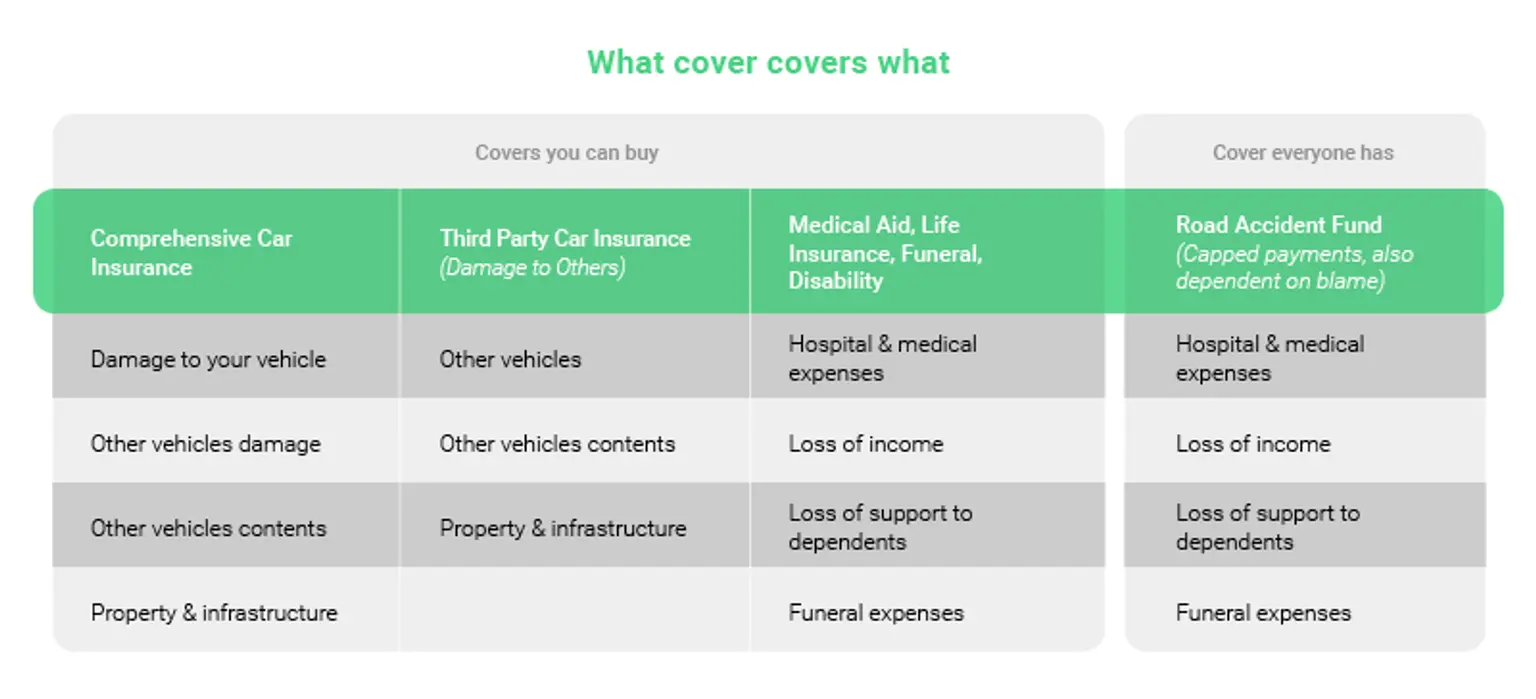

I know I’ve condensed a lot of research and movie viewing into a couple of pages, but I thought I’d condense it further into a handy table that summarises everything I’ve covered. I hope these case studies have provided a bit more clarity when it comes to knowing what covers cover what. If anything is still unclear, feel free to pop the Naked team an email at help@naked.insure!

And roll credits...