A checklist for what you need to look out for when insuring your bicycle.

Bicycles aren’t exactly cheap; some even cost more than what you’d pay for a small car. So it’s important to make sure you have the right cover and enough of that cover. Here are some things you need to know and consider when buying insurance for your bike.

What cover do you need when you own a bike?

❑ Theft and accidental loss cover

It’s no secret: there’s a good chance your bike could be stolen. There are many stories of bikes being snatched off roof racks, from the garden shed or even in front of the local coffee shop after a ride.

If you’re one of the unfortunate ones, it goes without saying that without insurance, you’ll be left with no bike and have to pay for another one yourself.

The same goes for loss. Although losing a bike sounds a bit absurd given that it’s quite a big thing to lose and doesn’t exactly fall out of your back pocket, it is possible if you’re leaving your bike in the hands of an airline, for example. But it’s also possible that your bike falls off your bike rack while you’re driving over Sir Lowry’s Pass and it goes off the side of the mountain. This will be covered by insurance as long as you take all reasonable care to secure your bike on the roof rack.

❑ Accidental damage cover

You could ride into a pothole or fall off your bike in a group ride and damage it. Or someone could drive into the back of your car, damaging your bike on its rack. These scenarios are possible and things you want to have covered by insurance.

HEADS-UP: Wear and tear/deterioration (and any consequential loss as a result of wear and tear) is usually not covered at all by insurance. Insurance is there to cover sudden, unforeseen events that take place at a clear point in time. So if you know you have a chip in your carbon fibre bike and do nothing to repair the chip and it proceeds to rust from exposure to water, your insurance will not cover the damage. It’s important to maintain your bicycle and do all you can to keep it in working order to keep you safe on the road.

And what about your fork collapsing on that bike you bought in 1993? While your bike is usually covered for accidents while you’re using it, insurance doesn’t cover damage that’s a result of old age, i.e. the parts naturally reaching the end of their life.

❑ Liability cover

Liability cover protects you if you accidentally injure someone or damage their property. For instance, if you cause an accident while on your bike and damage someone’s car or injure someone so seriously that they can no longer do their job, they can sue you for compensation. Personal liability cover is there to protect you when that happens. It’s automatically included in your home or contents insurance (and extends to your specified bike) but not when you buy standalone cover for your bike, which is a good argument for considering the former as opposed to the latter.

❑ In-Transit cover

Check that the insurance you’re going for covers your bike while it’s being transported. Whether it’s going on a flight with you or you’ve put it on a truck down to Cape Town for the cycle tour, you’ll want cover for it in case something happens to your bike while it’s being transported.

❑ Cover for your bike while you’re riding it

The reason you bought your bicycle was to ride it, so make sure that your insurer covers it for accidental damage or theft while you’re riding it.

❑ Cover for your bike during a race

Most insurers will cover your bicycle for the risks listed above during a race. It is safer to check with your insurer to avoid any unexpected surprises.

❑ Cover for when you’re travelling

If you’re planning on travelling abroad with your bike, your insurer should cover it for the same risks it faces when you’re not travelling. But to be 100% sure, you should ask your insurer what their policy is around travel.

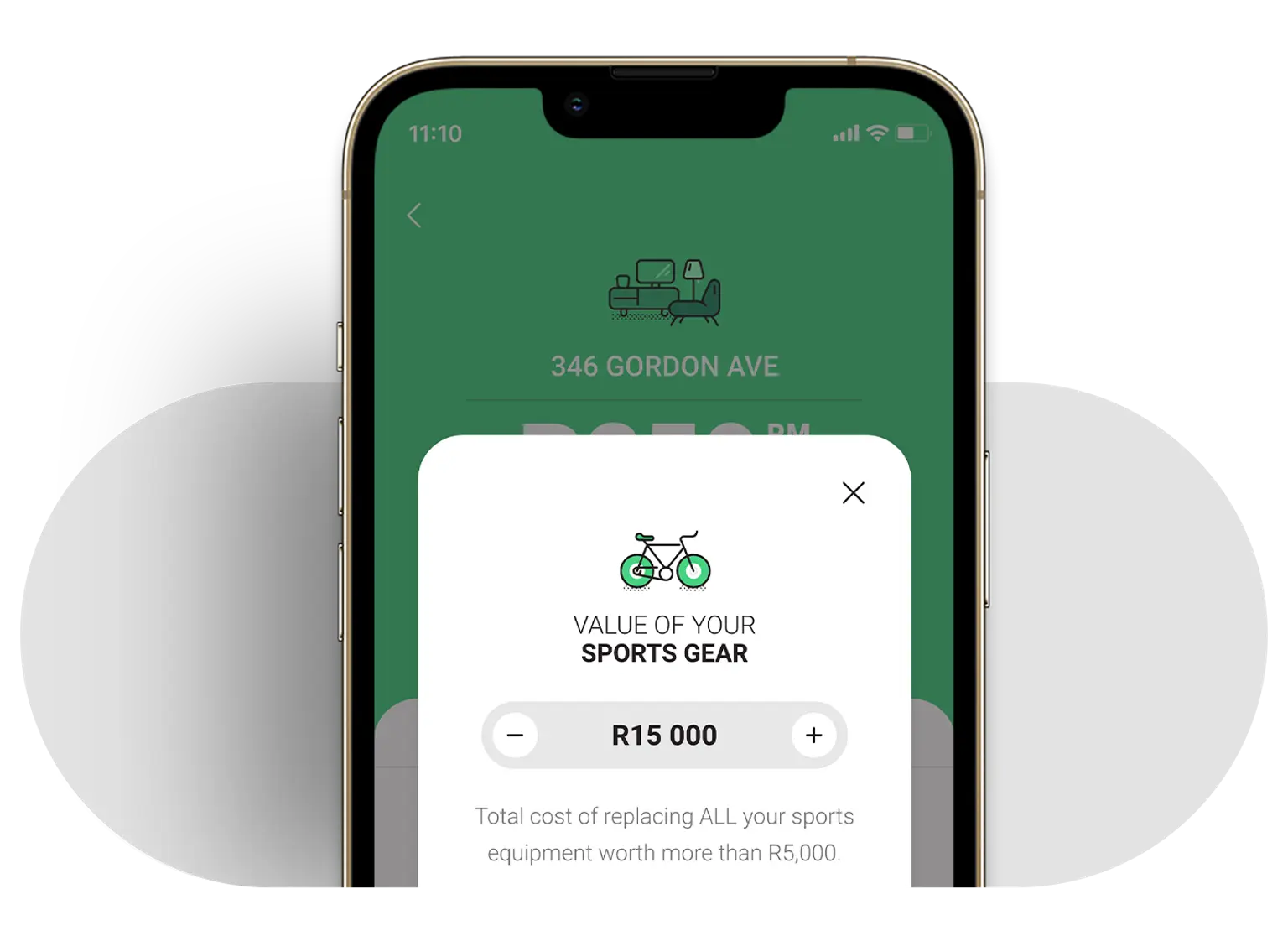

What about all my cycling gear? Is that included in my cover?

If you have home contents cover, things like helmets, cycling shoes, cycling kit, watches, and sunglasses should be covered at home, provided that you have included their value in the insured value of your home contents. Most insurers will require you to specify them as “all risk items” for them to be covered away from home.

If you don't have home or contents cover, standalone cover could be a good option. This route may prove more pricey because if you have to claim, you will have to pay a separate excess for each item you’re claiming for.

Other things to consider

How much should you insure your bicycle for?

So, you're wondering how much to insure your bike for? The golden rule is to insure it for what it would cost to buy new today. If the model of your bicycle is no longer sold, then insure it for the price of a similar one. If it's custom-built, make sure you're considering the price of every individual part.

Should you insure your bicycle under your home contents or as a standalone item?

If you already have a home contents policy, then it’s easy to pop your bicycle under that cover. Going this route will more than likely cost less than buying standalone cover, and you’ll have all of your stuff covered under one policy, reducing your admin. This route also means you have personal liability coverage if someone ever sues you for any damages.

If you don’t have home contents cover and aren’t convinced that personal liability cover is worth having then consider standalone insurance. This cover generally offers the same coverage as a home contents policy. Just think of it as buying one policy per item. So if you own a mountain bike and a road bike, you’d need to insure them separately.

What level should I set my excess at?

An excess is the amount that you will have to contribute if you have to claim. Think of it as your share in the loss. For example, let’s say you chose an excess of R2,000 and your bicycle that’s worth R60,000 is stolen. You will pay R2,000 towards the claim and your insurer will pay R58,000 (R60,000 - R2,000).

Remember that your excess directly affects your premium. The higher your excess, the lower your premium and vice versa. You’ll have to pay this amount every time you claim, so it should be a number that you can afford to pay at a moment’s notice, maybe more than once a year.

Will I be covered if I’m injured during a race?

This all depends on whether you have medical aid, personal accident cover and/or life insurance and what coverage your policies provide during a cycling event.

If you want to have more comprehensive cover during races, you can buy a Cycling South Africa membership for R250 a year. As a member you’ll receive a death benefit, and/or emergency medical treatment at a medical treatment facility and an emergency travelling cost benefit for any cycling-related accident that occurs at a Cycling SA-sanctioned cycling event. Note that a Cycling SA membership won’t cover you for damage caused to your bike, for liability cover or for the loss of a race entry fee. Some insurers also offer personal accident cover as an extension of your short-term policy or as a separate product. It covers you for accidental injury, death, or disability.

Do I need insurance if I’ve financed my bike through a loan?

If your bank helped you buy your bike, they'll probably want you to insure it. That way, if your bike ever takes an unplanned leave of absence, you're not left paying for air.

Cycling offers unique experiences but isn't a cheap sport. However, getting the right insurance for your gear and bike is fairly straightforward. To make protecting your bike even simpler, you can get a quote with Naked in under 10 seconds. Check out our Single Item cover or, usually for a lower price, add it to your Naked home contents cover.