If running, cycling, surfing or playing sport is your thing, you should consider protecting your gear.

Endless trails for running, cycling or hiking, beautiful waves along the coast to surf, and some of the best golf courses in the world to tee off on – South Africa offers a breathtaking, natural landscape that is hard not to take advantage of.

But many of these activities involve equipment and gadgets that don’t come cheap and are at risk of being stolen, lost or damaged. If your favourite surfboard is here today but gone tomorrow, will you be able to easily replace it from your own pocket? If not, you should consider buying cover to help you get back in the water sooner rather than later.

Here’s a guide to help you decide whether you need cover for your sports gear (like sports watches, kayaks, surfboards, bicycles, golf clubs, tennis racquets, etc.) and how to go about it.

Should you insure your sports gear?

When deciding whether you should insure your mountain bike, kayak or other sports gear, you should think about two things:

Firstly, there’s always the possibility that your surfboard might snap in the water or that your bicycle could be nicked off your car. If this did happen, would you be able to afford to replace it?

Secondly, it’s possible that bad things can happen more than once. Would you be able to replace your stolen or damaged stuff easily more than once? Or would it be a loss that you can afford? If your answer to either question is ‘no’ then insuring your sporting gadgets and equipment is probably a good idea.

What kind of cover do you need?

❑ Cover for theft, accidental damage, and loss

The first port of call when looking to buy insurance is to make sure that your policy covers theft, accidental damage and accidental loss. You wouldn’t want to pay a monthly premium for your Garmin sports watch only to find out that it’s not covered when you accidentally drop it.

❑ Cover while using it, especially away from home

Next, check if your insured gear is covered when it leaves your home – including when travelling internationally. And then also check that it is covered while it’s being used. It’s all good and well that your surfboard is covered as soon as you take it out the front door but it doesn’t really help if it’s not covered while you’re catching a wave and it breaks in half – you’d want it to be covered wherever you plan to use it.

Home contents or standalone insurance

If you already have a home contents policy, then it’s easy to pop your sports gear under that cover. Not only will it probably cost less than buying standalone cover, but you’ll also have all of your stuff covered under one policy, reducing your admin.

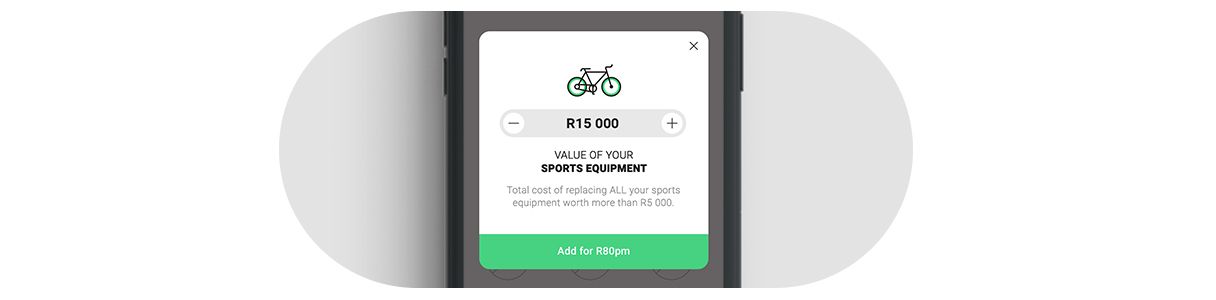

Naked’s contents policy automatically includes all your sports gear for up to R5 000 per item, at home or away from home. For any sports gear that’s worth more than R5,000, you just need to add them to the app to make sure you are covered for their full replacement value.

The added benefit of covering your sports equipment under your contents policy is that personal liability cover is automatically included. This means you have protection if you accidentally injure someone or damage their property. For instance, if you cause an accident while on your bike and injure someone so seriously that they can no longer do their job, they can sue you for compensation. Personal liability cover is there to protect you when that happens.

Another positive about insuring your sports gear through your home contents is that when your mountain bike and road bike are both stolen at the same time, you generally only need to pay one excess (the flat amount that you need to pay towards the claim).

If you don’t have home contents cover and aren’t convinced that personal liability cover is worth having then buying standalone cover is a good alternative.

Standalone cover generally offers the same coverage as a home contents policy. Just think of it as buying one policy per item minus the personal liability cover. So if you own a mountain bike and a road bike, you’d need to insure them separately. This also means that you'd pay two separate excesses if both were stolen at the same time.

Other things to consider

Do you need cover for races or sports events?

If you participate in races or other sports events, this is likely to be a time when your bicycle or kayak is most at risk. Before buying insurance for your sporting gear, check out what the terms and conditions are when it comes to participating in races. If it’s not covered in the insurance policy you’re looking at, it’s generally quite easy to buy race cover separately when you need it, from the race organisers.

What excess should you choose?

The excess is the amount that will come out of your pocket if you make a claim on your insurance. Think of it as your participation in the loss. When buying an insurance policy, you often get to choose this number and the level you choose will affect your premium. The higher your excess, the lower your premium and vice versa. Keep in mind that you’ll have to pay this amount every time you claim, so it should be a number that you can easily afford to pay.

For example, let’s say you chose an excess of R2,000 and you’re claiming for your Garmin that was stolen out of your gym bag, which you insured for R10,000. Your insurer will then pay you R8,000 and you will contribute R2,000.

What value should you insure your gear for?

If you want to make sure you’re not out of pocket when you claim, you need to insure your gear for what it would cost to replace it as new today. For example, if you bought a custom-made surfboard two years ago, it might cost more to have a new one made today. So always try to find out the replacement value of your things. The same goes for electronic items. If the model you have has been discontinued, find out the price of the next model up from yours and insure it for that.

This is really important if you want to end up in the same position as you were in before the loss.

The value of your sports gear adds up. And if you can’t afford to replace it all in cash today, then insuring it is a good option. After all, you don’t want to be stuck inside on a sunny, beautiful day when all your mates are enjoying the outdoors surfing, running or cycling.

If you haven't thought about insuring your fitness watch or favourite golf set until now, have a look at our Single Item cover for instant protection.