A quick guide to understanding what insurance you need as a freelancer.

You’ve insured your car, laptop and camera. But are you covered if you use these things for work? The lines can be blurry, and it often depends on what you do and where/how often you do it.

Insurance and the work-from-home culture

The past few years have seen an increase in the number of people moving into the freelance/gig economy. More recently, the whole world has had to shift to working from home (WFH) in light of the COVID-19 pandemic. For some, this shift may become a more permanent part of their future as companies move towards a more autonomous way of working.

“Now more than ever there is an opportunity for entrepreneurs and freelancers to take control of their income, and many are seizing that opportunity.” — Forbes

But if you’ve taken the bold step into the world of freelancing or working for yourself, don’t forget to make sure any essentials like your laptop, and camera are covered for work-related activity.

Many freelancers don’t have a fixed “office space” and rely on the tech items that they cart around from meeting to meeting. But of course, when they’re not on the road, they store these items in their homes – which has insurance implications.

Here’s a guide to determining whether your home contents policy will do the trick or if it’s time for business insurance:

What business-related use will my home contents policy cover?

Most home contents policies cover items like cell phones and laptops for business use, while they are at your home.

However, to ensure they are covered when you take them out of your home, they usually need to be specified explicitly under your home contents policy.

If you find yourself using more specialised items, like cameras, recording equipment or lighting gear you will need to read your policy in a bit more detail to see if you’re covered.

These are the four most common questions we get asked about what a home contents policy covers when it comes to business use:

1. If I use this specialised equipment away from home to do my work, am I covered for theft, loss or accidental damage under my home contents policy?

In most cases you will need to specify the items you want covered when you take them out of the house.

Even if you have specified them, it is still important to check if you’re covered if you use them for work. Make sure you cover all your bases: ask your insurer what they specifically cover and tell them that you use this equipment to bring home the bacon.

2. If I store these items at home and they are stolen along with some of my personal belongings, is everything covered under my home contents policy?

Yes, most home contents policies will cover you in this case, even if you haven’t specified these items under your policy. Your home contents policy should also protect you against damages caused by things like fires and floods.

Just keep in mind that some policies have a cap on the amount that they will pay per item that isn’t specified.

3. If I lose any important data/information/media on my devices, will my home contents policy cover that?

Unfortunately, this type of loss is rarely covered under a home contents policy. This could also include being sued because of a security breach where important client information and data are put at risk. To cover these kinds of events, you will usually need a business policy.

4. If I lose my income as a result of my equipment becoming damaged, stolen, or lost, will my home contents policy cover me?

Home contents policies are designed to replace or repair your belongings if anything gets damaged or stolen. However, if you lose income when your camera is stolen because you can’t take wedding photos, your contents will not cover this loss. If your income must be protected, buying a business policy or income protection policy might be a better way to go.

When do I need specific business insurance?

One of the main reasons freelancers might find themselves needing a business policy is when their home becomes their main place of work. Here are a few examples of what makes your home your main place of work:

1. Your business needs special equipment to process or manufacture a product. You might have a few sewing machines or a few conventional ovens for your small baking business in your home.

If these items get stolen, you might not have cover if you have a standard home contents policy.

The same goes for any event caused by your business activities in which damage was caused to both your personal belongings and business equipment.

For example, if the ovens that you use for your catering business cause a fire that burns down your house and you don’t have a business policy, it is likely your insurer would not cover the loss.

2. You keep stock at home. If you have high-risk stock at home and you haven’t mentioned this to your insurer, it could result in you having no cover if your stuff in your home is damaged as a direct result of storing the stock. Also, the stock itself will generally not be covered under your home contents policy.

3. Clients/other freelancers or employees regularly visit your home for appointments and meetings. There’s always the risk that they might fall and get injured or their items might break on your premises and they sue you.

Your own personal liability cover under your home contents policy won’t cover this. You’ll need separate business liability insurance.

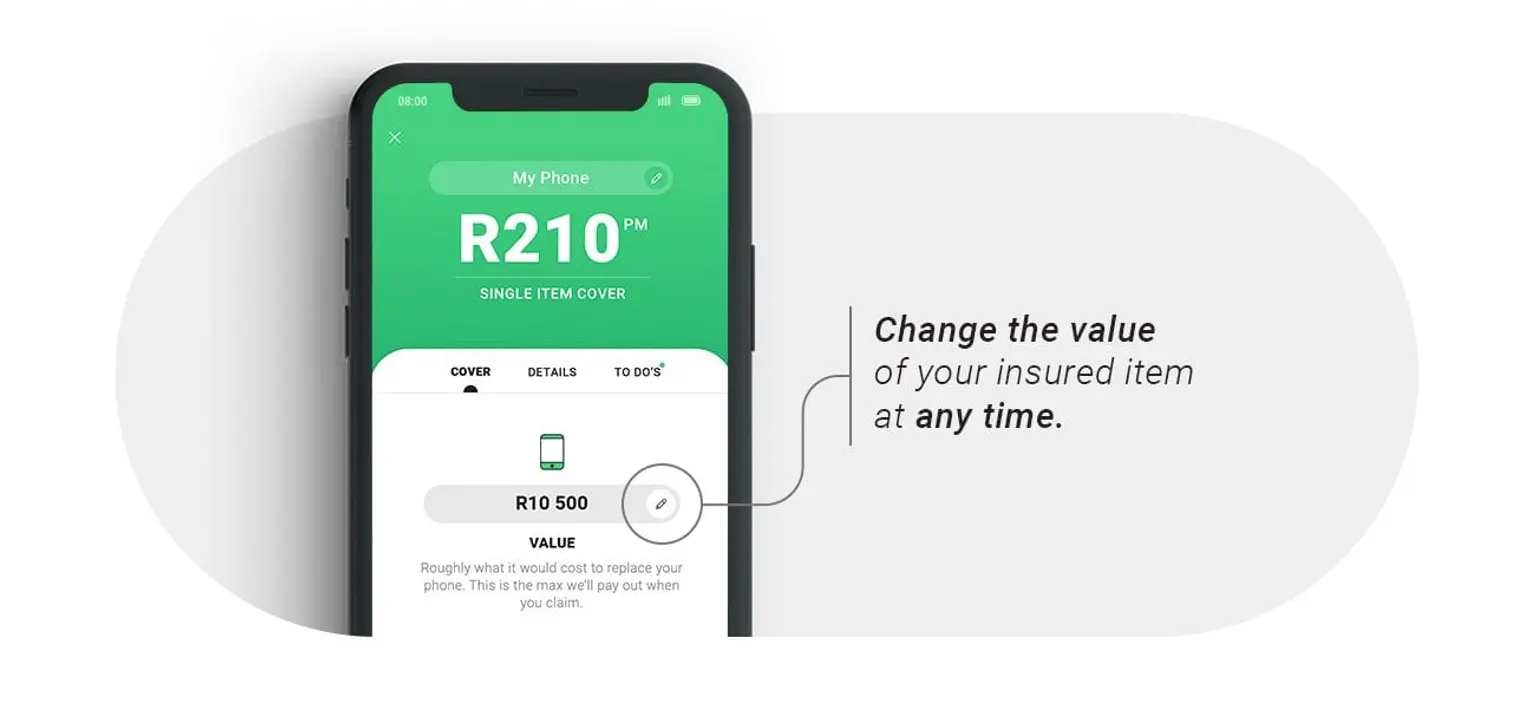

Your items should be insured for their replacement value ‒ what they cost new, today.

Once you know you have the right cover, it’s important to check if you have enough cover. Let’s say you are insuring your MacBook Pro 15-inch. You should insure it for what it would cost to replace it new, today — regardless of how long ago it was made. If the item you’re insuring has been discontinued, then you should insure it for the new cost of the next model up. In this case, it would be the MacBook Pro 16-inch.

When it comes to your excess, choose one that you can afford

When buying insurance, you’ll need to decide on an excess amount. The excess is the amount that will come out of your pocket when you claim.

Let’s say your R30,000 camera was stolen and your excess is R5,000. Your insurance company will contribute R25,000 and you will pay R5,000.

The higher your excess the lower your insurance premium will be and vice versa.

How do you choose the right excess?

The easiest way to calculate the best excess is to determine the amount you can comfortably afford to pay out of your pocket if and when you need to claim. This means you’ll avoid getting into trouble when it comes to claiming while minimising the amount you have to pay for insurance.

Going freelance can be daunting. There’s a lot to think about and so… much… admin

But don’t let that get you down. For any specialised equipment that needs to be insured for business use, you can buy Single Item cover with us. You can get an insurance quote in seconds on the Naked app and be insured in just a few minutes, so you can get back to doing the stuff you quit your 9-5 for.