Find out how much car insurance costs in South Africa in 2025, from R70 to R2 500 a month (depending on the car). Get your exact price in 90 seconds with Naked’s calculator.

Wondering “how much is car insurance per month in South Africa?” You’re not alone. With car ownership costs rising, most drivers want to know if they’re getting a fair deal or overpaying. The truth? Car insurance prices in South Africa vary widely depending on your car, your driving profile, and the type of cover you choose.

You’ve probably searched for a car insurance calculator to see what you’d pay. Most calculators just estimate, ours gives you a final, buy-ready quote in 90 seconds. Just click on ‘Get my price’ in the top right-hand corner 😉. No paperwork, zero hassle.

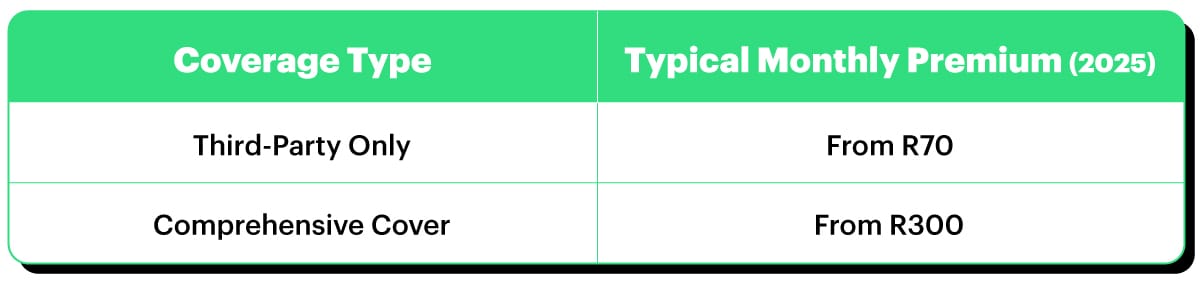

Here’s the breakdown of car insurance prices in South Africa:

What you’ll pay for car insurance

On average, most South Africans pay between R800 and R1,400 per month for comprehensive car insurance.

Prices vary by your car, where you live, and your risk profile.

Want your exact number? Try the Naked car insurance quote calculator in the app, or on the website, and you’ll get a personalised price you can lock in and buy in 90 seconds.

What is vehicle insurance?

Car (or vehicle) insurance is financial protection for you and your car. It covers the costs of accidents, theft, fire, weather damage, or damage you cause to others. Without it, one accident could leave you with repair bills worth hundreds of thousands of rand.

What affects the cost of car insurance?

1. Your car: Make, model and value

Expensive cars = higher premiums (Mercedes vs Suzuki Swift).

Repair costs matter: common, affordable-to-fix or locally manufactured cars often cost less to insure.

Example:

- Suzuki Swift: from ±R397/month

- Toyota Corolla: from ±R690/month

- Mercedes C-Class: from ±R1,122/month

2. Your driver profile

- Age and driving experience: Younger drivers (under 25) tend to pay more.

- Driving history: Fewer claims and clean records = lower premiums.

- Location: Living in areas with higher theft or more traffic will increase cost.

3. The type of cover you choose

Third-Party Only → The cheapest type of car insurance. It pays for damage or loss you cause to another person’s car or property, but if your own car is damaged or stolen, you’ll need to cover those costs yourself.

Comprehensive → Full protection for theft, accidents, fire, weather, plus third-party.

What’s the difference between comprehensive and third-party insurance?

Comprehensive car insurance costs more, but offers the most protection. It covers you for loss or damage to your own vehicle, including hijacking, theft, hail, storms, fire, lightning, explosions, malicious damage or accidental damage. You’re also covered if you’re liable for damages from an accident where someone else’s property is damaged by your car.

Optional extras (like car hire or credit shortfall cover) can be added to comprehensive insurance, which may increase your monthly premium.

Third-Party Liability Cover is the most basic form of protection, and the cheapest. It covers the damage your car might cause to other people’s property, but not your own.

Think of it like this:

- With comprehensive cover, both your car and damage to the other person’s property are protected.

- With third-party cover, only the damage to the other person’s property is protected.

4. How do excess and driver behaviour affect things?

- Higher excess (the amount you have to contribute to your claim) = lower monthly premium.

- Drive less? With Naked, you can pause your accident cover in the app and save up to 50% of your premium.

Need a car insurance calculator in South Africa?

Most online car insurance calculators only estimate your premium. You still have to call someone or fill in forms to get the real number.

The Naked car insurance calculator is different; it gives you a live, binding quote you can buy instantly.

How much does car insurance cost per month in South Africa?

Here’s what South Africans can expect in 2025:

- Hatchbacks: From ±R390

- Family sedans: From ±R470

- SUVs & luxury cars: From ±R640

Tips to make your car insurance more affordable in South Africa

- Increase your excess if you can afford it.

- Park in a secure spot (garage or complex).

- Drive less (Naked rewards low mileage).

- Keep your driving record clean.

- Compare policies; cheapest isn’t always best.

FAQs: car insurance prices in South Africa

How much does car insurance cost in South Africa?

From R70 (third-party) to R2,500+ (comprehensive), depending on cover and risk profile.

What’s the cheapest car to insure?

Models like the Suzuki Swift or Toyota Corolla typically cost less than luxury vehicles.

How much is insurance for a Mercedes?

Expect upwards of R800/month for a Mercedes, depending on driver profile and cover type.

Do calculators give exact prices?

Usually not, but Naked’s calculator does. It’s a real quote you can buy right away.

Can I get insurance per month?

Yes, car insurance in South Africa is paid monthly as a car insurance premium.

Car insurance in South Africa costs anywhere from R50 to R2,500 per month. Your car, your driving profile, and your type of cover make all the difference.

The fastest way to know your price? Get a comprehensive car insurance quote right now. It’s instant, transparent, and lets you buy your cover on the spot.